|

Getting your Trinity Audio player ready...

|

By: Jerome Brookshire

By any historical measure, the past year has marked one of the most consequential inflection points in modern American domestic policy. With a level of intensity not seen in decades, President Trump’s administration has implemented a sweeping enforcement campaign against illegal immigration—one that has not merely altered the demographic composition of U.S. metropolitan areas but is now visibly transforming the nation’s economic and social architecture.

Supporters of the administration have long argued that unchecked illegal immigration exerts downward pressure on wages, inflates housing demand, and erodes public safety. In 2025, those arguments are no longer theoretical. They are being written into price charts, payroll ledgers, and crime statistics across the country.

Nowhere is this more evident than in the real estate market, where a remarkable reversal is underway.

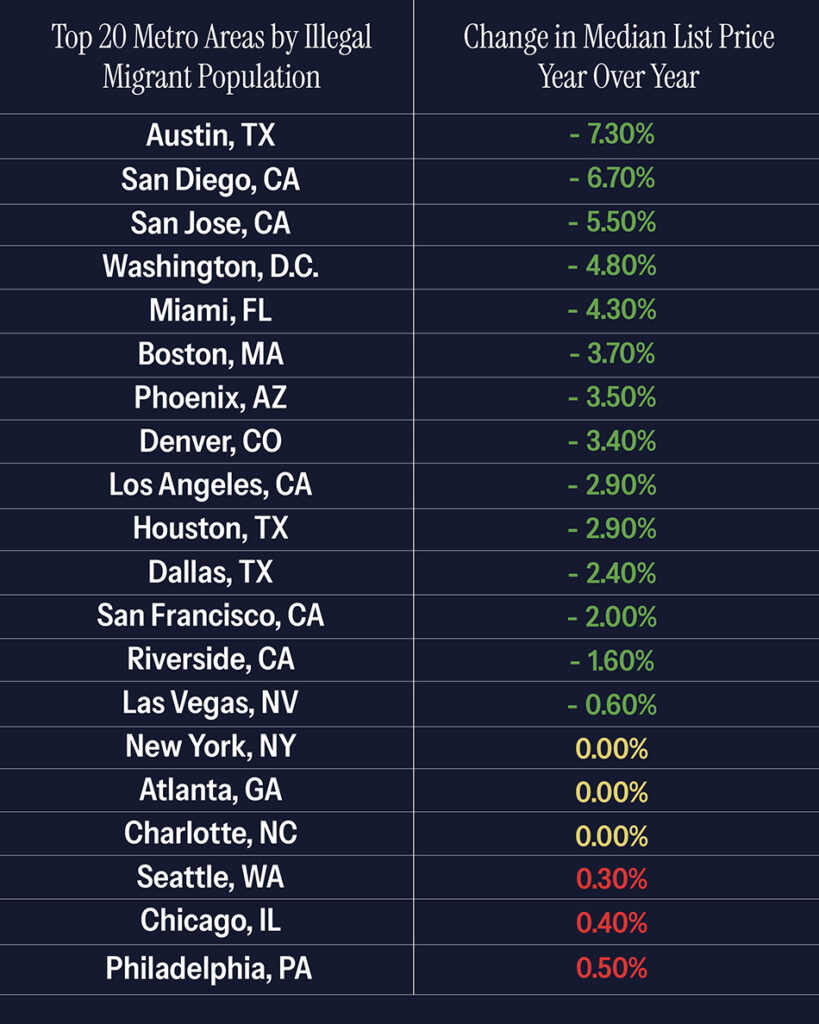

According to the data displayed in the accompanying graphic, 14 of the top 20 metropolitan areas with the largest illegal migrant populations recorded year-over-year declines in median home list prices in December. That is not a marginal shift—it is a systemic contraction after more than two consecutive years of relentless appreciation.

The steepest declines were recorded in cities long associated with large undocumented populations:

Austin, TX: –7.30%

San Diego, CA: –6.70%

San Jose, CA: –5.50%

Washington, D.C.: –4.80%

Miami, FL: –4.30%

Boston, MA: –3.70%

Phoenix, AZ: –3.50%

Denver, CO: –3.40%

Los Angeles and Houston both registered declines of –2.90%, while Dallas, San Francisco, and Riverside also showed measurable drops.

Only three cities in the top 20 recorded price increases, and each—Seattle (+0.30%), Chicago (+0.40%), and Philadelphia (+0.50%)—has been identified as maintaining “sanctuary” policies that restrict cooperation with federal immigration enforcement. New York, Atlanta, and Charlotte flatlined at 0.00%.

This bifurcation is not coincidental. It reflects the sudden contraction in housing demand as hundreds of thousands of undocumented residents exit markets where supply had been historically constrained. For years, housing affordability advocates blamed zoning, private equity, and interest rates. Yet the data now suggest a far more elemental driver: sheer population pressure.

With mass deportations removing that pressure, price inflation is cooling, and affordability—long the Achilles heel of American urban life—is beginning to return.

Parallel to the housing deflation is a phenomenon almost forgotten in recent decades: sustained real wage growth for native-born workers.

Industries traditionally saturated with foreign-born labor—trucking, construction, warehousing—are now reporting the most pronounced wage acceleration in a generation. Employers once accustomed to an endless supply of underpaid labor are being forced to compete for domestic workers.

The result is dramatic.

The administration projects that real wages will rise 4.2% in President Trump’s first full year, the strongest growth trajectory in decades. Truck drivers are reporting signing bonuses unheard of since the 1990s. Construction firms are raising base pay to retain crews. Even entry-level trade positions are commanding salaries once reserved for supervisory roles.

This is not inflationary noise. It is the restoration of labor scarcity—a market correction produced not by government subsidy, but by enforcement of the rule of law.

Between January and December 2025:

2 million native-born Americans gained employment.

662,000 foreign-born workers lost employment.

1.8 million native-born Americans joined the labor force.

881,000 foreign-born workers exited the labor force.

These are tectonic shifts.

For nearly half a century, American labor growth was disproportionately fueled by foreign-born workers, legal and illegal alike. Native-born participation stagnated as wages flattened and competition intensified. The 2025 figures represent a structural reversal—one that re-centers economic mobility within the citizen workforce.

This labor renaissance is not an abstraction. It is felt in households across the Midwest and Sunbelt, where families long priced out of stability are finding doors reopening.

Perhaps the most striking outcome of the enforcement campaign is its correlation with public safety.

The nation experienced the largest single-year decline in murders on record in 2025. Rapes, robberies, aggravated assaults, and shooting deaths all fell sharply. Overdose fatalities declined. On-duty law enforcement deaths dropped. Traffic fatalities reached their lowest levels in a decade.

The effect is especially pronounced in cities previously synonymous with violent crime:

Washington, D.C.: Murders down 60%, carjackings down 68%, overall crime down nearly one-third.

Chicago: Fewest murders since 1965; shootings down more than 33%.

Memphis: Fewer than 200 murders for the first time since 2019; shootings down nearly 40%.

New Orleans: Lowest homicide rate in nearly half a century.

These are not statistical flukes. They are the cumulative product of dismantling illicit networks that flourish in the shadows of porous borders—networks that traffic not only people, but drugs, weapons, and stolen vehicles.

The graphic underscores a telling pattern: the only metro areas resisting the downward housing correction are sanctuary jurisdictions. By refusing to participate in federal enforcement, these cities have insulated themselves from the relief experienced elsewhere—but at a cost.

While prices stagnate or continue creeping upward, these metros are increasingly isolated economically, socially, and politically. They remain magnets for undocumented populations at a time when national policy is moving in the opposite direction.

In effect, sanctuary cities are becoming policy enclaves—microstates operating under ideological inertia rather than empirical outcomes.

The Trump administration has not framed deportations as an end in themselves, but as a means to restore equilibrium across systems long distorted by demographic drift.

Lower housing costs are not merely about affordability—they reduce household debt exposure, ease intergenerational transfers, and stabilize local tax bases.

Higher wages do not simply benefit workers—they increase consumption, expand payroll tax receipts, and strengthen social insurance programs.

More jobs for native-born citizens reverse decades of labor force alienation, while lower crime reinvigorates neighborhoods hollowed out by fear.

The confluence of these trends is reshaping the American urban hierarchy.

Critics continue to warn of labor shortages, humanitarian crises, and economic contraction. Yet the empirical record of 2025 tells a different story: mass deportations, when executed in tandem with lawful employment practices, function not as economic sabotage, but as market normalization.

President Trump’s supporters argue that this is the long-overdue dividend of sovereignty—the restoration of national self-determination in a globalized economy that had forgotten its own citizens.

In their view, what is unfolding is not retrenchment, but renewal.

For years, the border debate was mired in abstraction—moral appeals on one side, alarmist rhetoric on the other. In 2025, the argument has moved from ideology to evidence.

Housing prices are falling in the metros most impacted by deportations. Wages are rising fastest in industries once hollowed out by labor oversupply. Native-born Americans are reentering the workforce. Crime is collapsing at historic rates.

This is not coincidence. It is causality.

Under President Trump, the enforcement of immigration law has ceased to be a political slogan and has become a measurable force—reordering the American city from the inside out.