|

Getting your Trinity Audio player ready...

|

By: David Avrushmi

In what CNN described as one of the most sweeping acts of private philanthropy in modern American history, tech magnate Michael Dell and his wife, philanthropist Susan Dell, announced on Tuesday a staggering $6.25 billion donation to seed investment accounts for at least 25 million American children. The donation—unprecedented in scale, design, and reach—instantly positions the Dells among the most consequential advocates for child-focused wealth creation in the United States.

Their gift is intended to supercharge the rollout of so-called “Trump Accounts,” a new federal initiative signed into law under President Donald Trump’s extensive One Big Beautiful Bill Act, which created a national framework for long-term tax-advantaged investment accounts for minors. According to the CNN report, the accounts are designed to help American children build savings that can grow across decades, harnessing the mathematical power of compound investment returns to create what proponents say could be a quiet revolution in intergenerational financial mobility.

The size of the Dells’ gift alone is stunning, CNN emphasized repeatedly: the couple had previously given an estimated $2.9 billion to various causes; Tuesday’s announcement more than doubles their lifetime charitable output in a single stroke. For a philanthropist already ranked as one of the richest individuals in the world—with Michael Dell’s personal fortune currently estimated at $148 billion, per the Bloomberg Billionaire Index—the scale of the pledge alters not only the conversation around family savings but also the national debate over economic opportunity for young Americans.

As CNN explained in its coverage of the announcement, “Trump Accounts” are structured as tax-deferred investment vehicles, mechanically similar to simplified retirement accounts but designed exclusively for children. Eligibility extends to any U.S. citizen child aged 18 or under with a Social Security number, making the program broadly inclusive and poised to reach families across the economic spectrum.

The federal government will deposit $1,000 into the account of every eligible child born between January 1, 2025, and December 31, 2028. But children born before that window—nearly all of America’s minors today—were originally left unfunded by the Treasury’s baseline structure.

That is precisely the gap the Dells set out to fill. According to the information provided in the CNN report, the couple’s donation will finance $250 deposits for children ten years old and under who were born before the Treasury’s eligibility window, representing at least 25 million children nationwide. If any funds remain following initial sign-ups, the program may expand to older children.

“It allows us to reach such a huge number of children with this program,” Susan Dell told CNN, underscoring an ambition to pair national policy with large-scale philanthropic leverage. “Investing in children and their future is really investing in all of our futures,” she said, a point CNN highlighted as emblematic of the Dells’ long-standing commitment to childhood welfare.

For Michael Dell, who founded Dell Technologies in 1984 at age 19, the mathematical potential of long-term investment was the central inspiration behind the historic pledge. “If you think about the power of compounding and what these accounts are likely to become over 10, 20, 30 years—that’s super significant,” he told CNN.

The accounts will be invested primarily in mutual funds and index funds, including those tracking benchmarks such as the S&P 500. Private parties will be permitted to contribute up to $5,000 annually, and employers may contribute up to $2,500 of that sum.

Withdrawals cannot be made until the child reaches age 18, at which point the account transforms into the functional equivalent of a traditional IRA. Funds may then be used for education, first-time home purchases, or capital to start a business, subject to broad IRA-style rules that CNN said could make these accounts a “transformational financial gateway” for an entire generation.

While the program shares some conceptual DNA with 529 college savings plans, CNN noted that analysts at the Tax Foundation cautioned that the proliferation of specialized savings accounts could make financial planning more complex. Still, those concerns have been largely overshadowed by enthusiasm surrounding the program’s scope and its enormous philanthropic infusion.

Enrollment for Trump Accounts will begin on July 4, 2026, symbolically aligning the program with the Independence Day holiday. As CNN reported, accounts will be opened online through a federal portal, and parents will be able to begin contributing immediately. Distribution of the Treasury-funded $1,000 deposits—and the Dell-funded $250 deposits—will flow through the U.S. Treasury Department itself.

These funds, according to Invest America (the nonprofit founded by Altimeter Capital CEO Brad Gerstner), will be targeted toward children in ZIP codes with median household incomes under $150,000, a measure the organization says ensures coverage across roughly 75% of all ZIP codes in the country.

“What we hope is that children will see that there is a future worth saving for,” Susan Dell told CNN. “If every child sees that, then we’ll have been a part of helping build that hope and opportunity and prosperity for generations to come.”

As CNN reported, Michael Dell revealed that the couple has already spoken to “a number of other philanthropists,” expressing confidence that additional major gifts will soon follow. The architecture of the Trump Accounts—federal seed money blended with private capital—was deliberately crafted to encourage this kind of nationally scaled philanthropic participation, much of it aimed at expanding program access for children beyond the Treasury’s funding window.

Gerstner, who founded Invest America in 2021 after years of advocating for children’s savings initiatives, described the Dells’ gift to CNN as a “historic model” for integrating public policy with private generosity.

The idea dates back several years. Dell initially discussed the savings framework with the Biden administration, CNN reported, but the conversations yielded no clear pathway for implementation until Trump revived the proposal earlier this year.

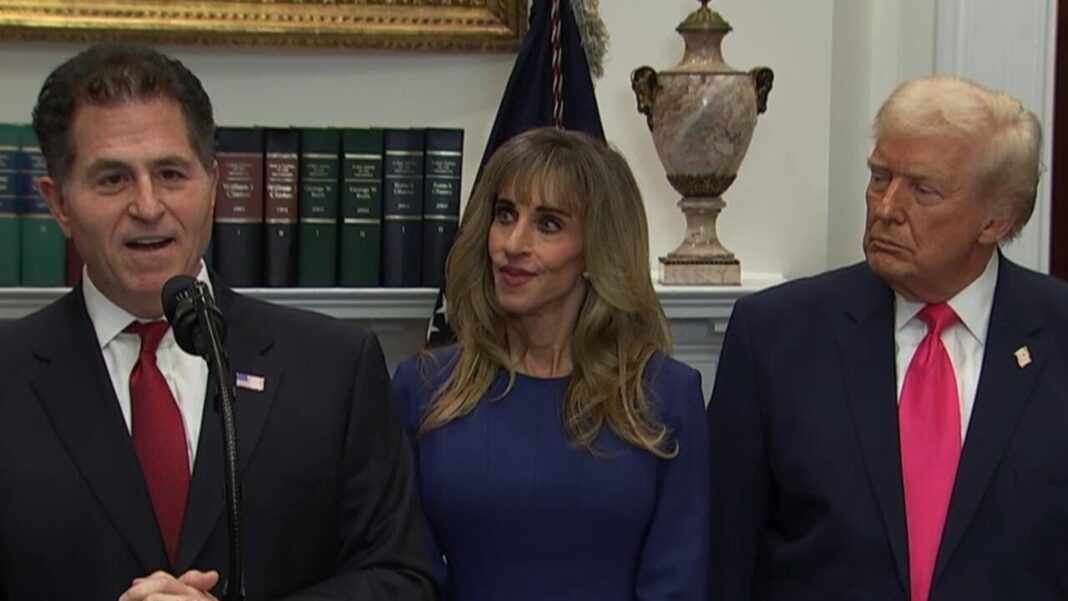

When Dell appeared at the White House in June alongside other business leaders as Trump formally announced his support for what would become Trump Accounts, the tech mogul was, as CNN put it, “visibly energized” by the possibility of building a universal financial foundation for American children.

“The smartest investment we can make is the one we make in children,” Dell said at the event—a statement CNN framed as the philosophical lodestar of Tuesday’s sweeping philanthropic announcement.

CNN’s analysis noted that beyond its enormous numerical footprint, the Dells’ gift represents something even rarer: a $6.25 billion expression of optimism in America’s long-term potential. At a moment when economic anxiety, inflation concerns, and generational pessimism often dominate national discourse, the donation is—at minimum—a counter-narrative, and at maximum a generational intervention in the architecture of opportunity itself.

It is also a philanthropic gamble designed to unfold gradually over decades, not years. As Invest America pointed out, even modest annual investment returns, compounded over 18 to 30 years, could transform small deposits into foundation capital for education, entrepreneurship, or homeownership.

In effect, the Dells’ contribution isn’t only a gift; it is a structural wager on the long arc of American prosperity.

The CNN report emphasized repeatedly that the Dells’ announcement alters the national conversation around child savings and financial mobility. Unlike previous philanthropic efforts aimed at K–12 education, early childhood development, nutrition or direct social services, this one focuses squarely on asset-building, placing the power of compounded financial growth in the hands of millions of future adults.

This shift—from charitable service to wealth-generating investment—is what makes the donation so singular and transformative, CNN argued.

And if the Dells’ example sparks a wave of similar contributions—as both Michael Dell and Gerstner expect—the United States may be on the brink of a new era in public–private cooperation for children’s financial futures.

For now, the Trump Accounts program represents the broadest federal intervention in childhood savings since the development of 529 plans decades ago. But CNN’s coverage suggests that the Dells’ massive gift may ultimately define how the program is remembered: not simply as a presidential initiative, but as a philanthropic movement capable of reshaping the long-term financial security of an entire generation.

In the story of American philanthropy—a story defined by names like Carnegie, Rockefeller, Ford, and Gates—the Dells have now staked a place of their own. And in the story of America’s children, their $6.25 billion gift may one day be seen not as an extraordinary act, but as a turning point.