|

Getting your Trinity Audio player ready...

|

By: Andrew Carlson – Jewish Voice News

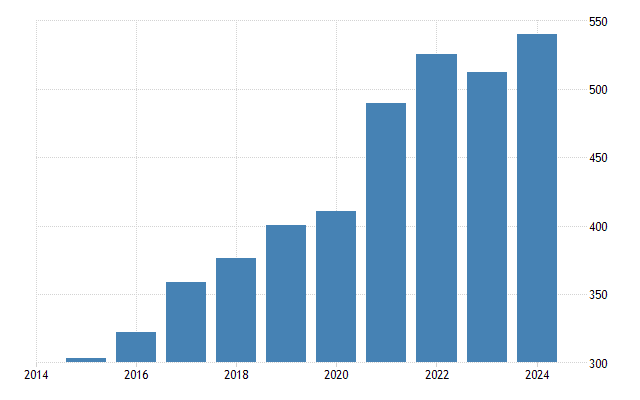

As Israel approaches its 80th anniversary, its economy—resilient, dynamic, and increasingly diversified—stands on the threshold of a transformation that could redefine its global stature. With a current gross domestic product (GDP) of roughly $540 billion to $564 billion, according to recent 2024 estimates, Israel is already counted among the world’s most advanced economies. Yet economists now project that, at a steady 5% annual growth rate, Israel could reach the symbolic milestone of a $1 trillion GDP by 2038, cementing its place among the top-tier economic powers of the 21st century.

This projection, based on a straightforward compound growth model, may appear abstract at first glance. But beneath it lies a complex interplay of innovation, strategic investment, geopolitical tension, and demographic dynamism that continues to shape Israel’s economic destiny. Whether this forecast materializes will depend not merely on mathematical consistency but on how effectively Israel can balance its extraordinary technological drive with the enduring pressures of regional conflict and global economic turbulence.

The calculation itself is elegant in its simplicity. Using the compound interest formula—

FV=PV(1+r)tFV = PV (1 + r)^tFV=PV(1+r)t

where FV is the future value ($1 trillion), PV is the current GDP ($540 billion), r is the annual growth rate (5%), and t represents time in years—Israel’s GDP trajectory can be estimated with precision. Solving for t yields approximately 12.7 years, meaning that if the economy sustains its current pace, Israel’s GDP would surpass $1 trillion by around 2038.

This model assumes steady nominal growth, an optimistic but not implausible scenario for a nation that has repeatedly defied economic expectations. In fact, historical data underscores Israel’s capacity for long-term expansion: since the 1990s, it has averaged annual growth rates between 4% and 5%, even amid wars, political instability, and global recessions.

A more aggressive projection—one based on a 6% annual growth rate, as proposed by some analysts—would push Israel’s GDP to $1.6 trillion by 2048, the state’s centennial year. Yet even the more conservative 5% estimate, if sustained, would elevate Israel into a new league of global economic influence—rivaling mid-sized G20 economies like South Korea, Canada, and Australia.

The engine driving this expansion is innovation—a word so often associated with Israel that it has become synonymous with its national identity. The country’s transformation from a resource-scarce state into a global high-tech superpower is perhaps the most remarkable economic story in modern history.

Israel’s technology sector accounts for nearly 18% of GDP and more than half of its exports, according to Ministry of Finance data. Tel Aviv’s thriving startup ecosystem—often dubbed “Silicon Wadi”—is now second only to Silicon Valley in venture capital investment per capita. From artificial intelligence and cybersecurity to fintech, quantum computing, and biotechnology, Israel’s creative output has become an indispensable component of the global innovation chain.

In the past decade, multinational giants such as Intel, Google, Microsoft, and Nvidia have expanded their R&D operations in Israel, drawn by its deep talent pool and advanced research infrastructure. These investments have helped sustain GDP growth even during periods of external stress. According to the Bank of Israel, foreign direct investment (FDI) remains strong, buoyed by a reputation for agility, technical expertise, and economic stability.

As one Tel Aviv venture capitalist recently told a financial roundtable, “Israel doesn’t export goods—it exports ideas. And ideas compound faster than any interest rate.”

Alongside its technological prowess, Tel Aviv’s emergence as a regional financial hub represents another major pillar of Israel’s growth trajectory. Over the past decade, the city’s financial infrastructure has undergone a quiet revolution: new fintech platforms, regulatory modernization, and international partnerships have positioned Israel as a bridge between Western capital markets and the innovation economies of Asia and the Gulf.

The Abraham Accords, which normalized relations between Israel and several Arab nations in 2020, opened up new channels for investment and trade. Israeli financial institutions have since expanded their reach into markets such as the United Arab Emirates, Bahrain, and Morocco, while joint ventures in renewable energy, logistics, and digital infrastructure are helping reshape regional commerce.

Tel Aviv’s Stock Exchange (TASE), historically small and domestically focused, has begun courting foreign listings and cross-border financing deals. As Israel National Bank economists note, “If Tel Aviv consolidates its role as the regional financial nucleus, it could add several percentage points to long-term GDP growth through capital inflows and liquidity expansion.”

Yet even a nation as dynamic as Israel faces formidable challenges on the road to its trillion-dollar goal.

First and foremost are geopolitical pressures—persistent conflicts with Hamas and Hezbollah, rising regional instability, and the heavy fiscal burden of maintaining one of the world’s most technologically sophisticated defense forces. Since the October 2023 conflict with Hamas, Israel’s defense spending has surged, straining public finances and diverting capital from long-term investment projects.

Israel’s debt-to-GDP ratio, though moderate by OECD standards, could rise significantly if defense outlays remain elevated without offsetting revenue growth. Meanwhile, the cost of reconstruction in affected southern regions and the economic toll of reserve mobilization weigh on consumer confidence and labor productivity.

Moreover, the Israeli economy remains heavily dependent on foreign trade, importing raw materials and energy to sustain its industrial and manufacturing sectors. Global supply chain disruptions, commodity price volatility, and political boycotts—though limited—pose ongoing risks.

Forecasts for 2025 GDP growth, ranging between 2.7% and 3.5%, reflect these uncertainties. The Bank of Israel’s latest monetary outlook warns of “temporary deceleration amid external shocks and elevated defense-related expenditures,” but also predicts a return to long-term averages once security conditions stabilize.

Despite these headwinds, Israel’s economic resilience has repeatedly defied conventional macroeconomic logic. The state’s robust institutional framework, high human capital, and strong entrepreneurial culture have insulated it from many global shocks.

During the global financial crisis of 2008–2009, Israel was among the few OECD countries to avoid recession entirely. During the COVID-19 pandemic, it rebounded faster than most Western economies, with GDP growth surging to over 6% in 2021, supported by its rapid vaccination campaign and digital adaptability.

Even amid the 2023–2024 Gaza conflict, Israel’s tech exports, venture funding, and R&D spending remained relatively stable—a testament to the economy’s structural diversity. “The Israeli economy can function under duress because it has built resilience into its DNA,” an analyst at the Jerusalem Institute for Market Studies observed. “War is tragic, but it does not erase innovation.”

Another cornerstone of Israel’s growth potential lies in its demographics. Unlike many advanced economies facing population decline, Israel’s population—now surpassing 9.8 million—is growing at nearly 2% per year, driven by both natural increase and immigration.

The country’s workforce is exceptionally well-educated: over 50% of Israelis hold tertiary degrees, one of the highest rates in the OECD. Israel consistently ranks among the world’s leaders in R&D expenditure as a percentage of GDP, with government and private-sector research spending hovering around 5.6%—far exceeding the OECD average of 2.7%.

This human capital advantage gives Israel a long-term productivity edge, allowing it to sustain above-average growth even as other developed economies stagnate. However, continued integration of Haredi (ultra-Orthodox) and Arab-Israeli communities into the high-tech and professional workforce remains crucial for realizing the nation’s full potential.

While Israel’s tech narrative dominates headlines, the coming decade may see breakthrough growth in other sectors, including renewable energy, precision agriculture, and artificial intelligence applications across traditional industries.

Government-backed initiatives to transition toward energy independence—including offshore natural gas development and investment in solar infrastructure—could dramatically reduce Israel’s import reliance. Meanwhile, Israeli agritech firms are pioneering solutions for water scarcity, sustainable irrigation, and desert farming, offering exportable expertise to climate-vulnerable regions worldwide.

AI integration, particularly in healthcare, finance, and defense, is expected to add billions to GDP through productivity gains and cost efficiency. “The next phase of Israel’s economic miracle will be about applying innovation to everything—not just software,” noted one venture economist in a 2024 panel discussion.

Projecting a nation’s economic trajectory over 15 years is always an exercise in controlled speculation. Yet the underlying logic of Israel’s trillion-dollar pathway is not merely statistical—it is structural.

If Israel maintains nominal GDP growth of 5%, continues to attract foreign investment, and sustains technological leadership, the $1 trillion milestone by 2038 is achievable. A more tempered trajectory—around 4% annual growth—would push the timeline toward the early 2040s, while maintaining Israel’s global ranking as one of the most prosperous economies per capita.

But beyond the numbers lies something deeper: the story of a nation that has consistently turned adversity into advantage, scarcity into ingenuity, and survival into strength.

From the arid sands of the Negev to the glittering skyline of Tel Aviv, Israel’s economic ascent is not just about reaching a trillion-dollar GDP. It is about affirming a national ethos—one that sees innovation not as luxury, but as necessity; and progress not as destiny, but as the deliberate work of visionaries who understand that the future, like compound growth, is built one year at a time.