|

Getting your Trinity Audio player ready...

|

By: Russ Spencer

New Yorkers already reeling from some of the highest living costs in the nation are now facing another crushing expense — skyrocketing auto insurance premiums fueled by an epidemic of organized fraud. According to a blistering new report from Citizens for Affordable Rates (CAR), staged car crashes and sham medical claims have created a “criminal ecosystem” that is costing every driver in the state an estimated $300 a year in inflated premiums.

In a consumer alert issued Wednesday, CAR accused what it called “criminal fraud rings” of orchestrating elaborate collision scams and manipulating New York’s no-fault insurance system, while urging Governor Kathy Hochul to take immediate action. The group’s newly released fact sheet lays out a damning indictment of how these schemes operate — and how lax oversight has allowed them to flourish at consumers’ expense.

“Staged car crashes are organized criminal enterprises preying on hardworking New Yorkers and costing every driver an extra $300 a year in premiums,” said José Bayona, a spokesperson for CAR. “We are issuing this urgent warning so consumers can protect themselves and understand why insurance costs are climbing so steeply.”

A Growing Criminal Industry on New York’s Roads

The CAR report, titled “Crash-for-Cash: The Hidden Crime Behind New York’s Insurance Crisis,” reveals a complex web of coordinated fraud involving deliberate car crashes, fake medical clinics, and bogus lawsuits. Together, these operations have become a lucrative underground business that exploits weaknesses in state insurance law and enforcement capacity.

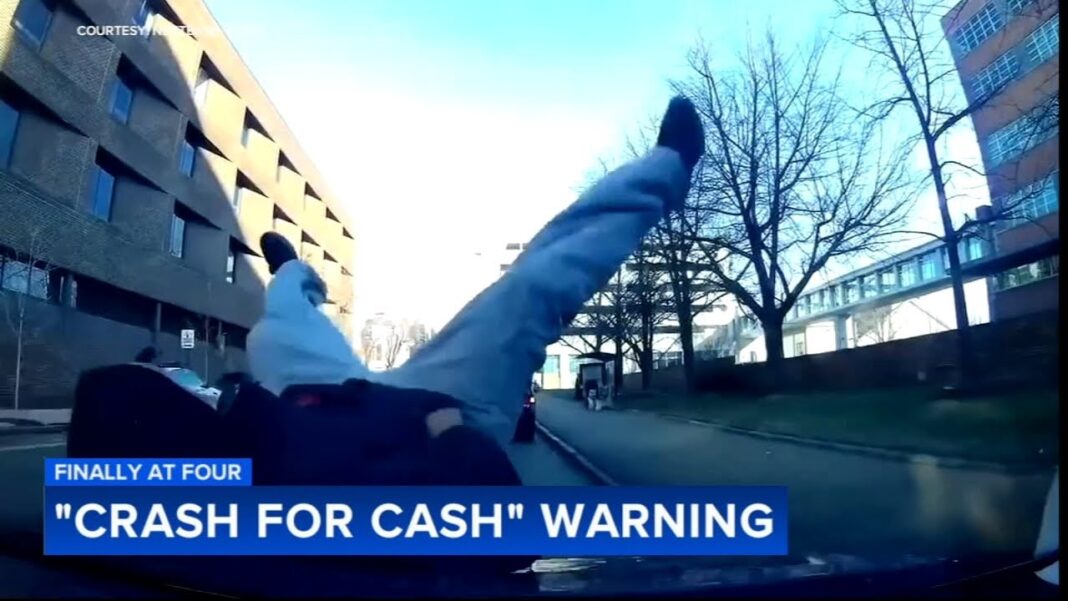

According to CAR, the most common schemes involve “brake slamming” and “swoop and squat” tactics — maneuvers in which criminals intentionally cause accidents by cutting off or suddenly stopping in front of unsuspecting drivers. Once the crash occurs, the fraudsters file inflated medical and damage claims, often aided by complicit doctors and attorneys who pad the paperwork with fabricated injuries.

https://youtu.be/wyGJhxoB2nw?si=7c5lTWTS4eS_Bu9G

CAR’s data, citing the New York State Department of Financial Services (DFS), paints a staggering picture: staged accidents and inflated medical claims account for roughly 75% of all insurance fraud cases in New York. These scams, the report warns, are not isolated acts but the work of organized criminal rings that recruit vulnerable individuals as “pawns,” while the ringleaders pocket millions in illicit profits.

The Mechanics of Fraud: How Criminals Exploit the System

One of the main reasons New York has become a magnet for this type of fraud, CAR contends, is its no-fault insurance law, which requires insurers to pay medical claims within 30 days of an accident — long before thorough investigations can be completed.

“New York’s no-fault framework was designed to protect consumers,” the report states, “but instead it has created a perverse incentive structure that allows criminals to get paid first and face scrutiny later.”

Fraudulent medical clinics, sometimes referred to as “medical mills,” play a critical role in these scams. CAR’s fact sheet describes how these operations submit medical bills that can exceed $50,000 per staged crash, using falsified treatment records or unnecessary procedures. The clinics often operate under shell corporations or straw owners to obscure the involvement of criminal organizations.

Meanwhile, “sham lawsuits” filed by unscrupulous attorneys further compound the problem. By suing insurers for “bad faith” claim denials or exaggerated damages, these legal actors pressure companies into costly settlements that are ultimately passed on to policyholders.

CAR’s warning emphasizes that the combination of quick-payout rules, lax oversight, and the sheer profitability of these schemes has created a “fraudster’s paradise” in New York’s auto insurance market.

The Human Cost: Families and Businesses Struggling to Cope

While the scale of the fraud is staggering, CAR’s message underscores a more personal toll: working families who can no longer afford to insure their vehicles.

“Rising premiums force working families to choose between car insurance and other essential expenses, such as groceries,” the alert warns. “Small businesses and workers absorb crushing transportation costs that threaten livelihoods.”

According to CAR’s analysis, New Yorkers now pay an average of $4,031 annually for full auto coverage — nearly 40% above the national average. In some parts of the state, particularly in New York City and Long Island, premiums have reached crisis levels, with 5.2 million residents living in areas where coverage is considered unaffordable.

The financial strain is fueling another dangerous side effect: the rise of uninsured drivers. CAR estimates that roughly 11% of New York motorists now drive without coverage, often because they simply cannot pay the premiums. That, in turn, has led to an uptick in hit-and-run accidents, compounding both public safety and insurance burdens.

“This is not just an economic issue — it’s a moral one,” said Bayona. “Families are being forced to make impossible choices, while criminals enrich themselves off their suffering. Every staged crash is another driver’s paycheck stolen.”

A Call for Albany to Act

CAR’s alert does not mince words about what it sees as Albany’s failure to confront the problem. The coalition insists that Governor Kathy Hochul has both the authority and the obligation to intervene immediately.

“The Governor can end this crisis with the stroke of a pen,” Bayona said. “New York families are bleeding money every single month while Albany dithers. The Governor must act now and restore fairness to the auto insurance market.”

CAR’s recommendations outline a four-part plan designed to dismantle the fraud networks and restore trust in the system:

Extend Investigation Periods – Give insurers more time to vet suspicious claims before payment deadlines.

Crack Down on Fraudulent Clinics and Attorneys – Empower regulators and law enforcement to suspend or revoke licenses and impose steep penalties.

Toughen Criminal Penalties – Introduce mandatory jail sentences and asset forfeiture for individuals involved in organized staged-crash rings.

Create Specialized Fraud Prosecution Units – Establish task forces dedicated exclusively to prosecuting staged-accident operations.

“These aren’t abstract reforms — they are lifesaving policies,” CAR said in its statement. “Every day that passes without reform is another payday for the criminals who make a mockery of New York’s laws.”

Why the Stakes Are Rising

The CAR report situates the issue within a larger context of economic strain and systemic failure. It notes that the combination of inflation, surging vehicle repair costs, and increased claim activity has already driven premiums higher across the nation. But in New York, the added burden of pervasive fraud has pushed the system to a breaking point.

“The math is simple,” the report says. “When fraudsters file millions in fake claims, insurers raise rates to recover the losses. And who pays? Every honest driver in the state.”

Industry experts agree that without swift intervention, New York’s insurance crisis could deepen. “Fraud doesn’t just hurt insurance companies—it hurts consumers, businesses, and the entire economy,” said one insurance analyst who reviewed CAR’s findings. “When costs spiral out of control, people start cutting corners, dropping coverage, or driving illegally. It’s a vicious cycle.”

CAR’s data aligns with trends identified by the National Insurance Crime Bureau (NICB), which has consistently ranked New York among the top five states for staged accident fraud.

Consumer Awareness: The First Line of Defense

While CAR’s primary message targets policymakers, the organization also urges ordinary drivers to be more vigilant. Its alert advises motorists to be cautious in high-traffic zones where staged crashes often occur — such as intersections and exit ramps — and to document every detail of an accident scene, including dashcam footage and witness statements.

“Knowledge is power,” Bayona said. “If you’re involved in a suspicious crash, don’t confront the other driver — call the police and your insurer immediately. The more evidence you have, the harder it is for fraudsters to manipulate the system.”

The organization also directs drivers to its website, www.

A Crisis That Demands Leadership

As CAR’s alert reverberates through Albany, it crystallizes a larger debate over accountability — not only of criminals, but of lawmakers themselves. For years, industry advocates have warned that loopholes in New York’s insurance laws were being exploited with impunity. Now, the costs of inaction have become impossible to ignore.

“Staged accidents are not victimless crimes,” CAR concludes in its report. “They are a form of theft — organized, deliberate, and devastating to every honest driver on New York’s roads.”

Whether Governor Hochul will move to strengthen enforcement remains to be seen. But as CAR’s Bayona put it, the stakes could not be clearer: “Families deserve fair, affordable insurance — and they’re counting on Albany to act before the system collapses.”

About Citizens for Affordable Rates (CAR)

Citizens for Affordable Rates is a statewide coalition of consumers, advocates, and organizations committed to exposing the root causes of New York’s high insurance premiums. Through policy reform and public education, CAR aims to build a fair, transparent, and affordable insurance system for all New Yorkers.

For more information, visit www.