|

Getting your Trinity Audio player ready...

|

By: Benyamin Davidsons

Shares of the Illumina Inc stock rallied on Monday, as reports came out that activist investor Carl Icahn may be planning for a proxy fight.

As reported by the Wall Street Journal, Icahn holds that Illumina cost its shareholders some $50 billion by moving forward to acquire Grail Inc despite opposition from regulators. Illumina is an international biotechnology company, headquartered in San Diego, California, which boasts superior DNA-sequencing capabilities. The company, first founded in1998 has been a stock-picker favorite, and in the summer of 2021 it was valued at over $70 billion.

Over the last few months, however, its value has dropped drastically, hovering at about $30 billion. The problems began when Illumina agreed to purchase cancer-screening company Grail in 2020. Grail, which was founded in 2015 by Illumina but later spun-off, develops blood tests for early cancer detection. In 2021, Illumina announced an agreement to buy back the parts of Grail that it didn’t already own for $7.1 billion.

The problem was that because the companies were at that point competitors, both the Federal Trade Commission and European Union threatened to block the deal over anti-trust concerns. The company forged ahead with the purchase despite the risk. Since then, the U.S. FTC has backed down, but the EU has sought to ban the acquisition saying it would hurt innovation and stifle consumer choice. The deal is now in limbo. Last year, Illumina appealed the European Commission’s decision and has said it would review strategic alternatives for Grail for the chance that it won’t be able to delay the EU divestment order.

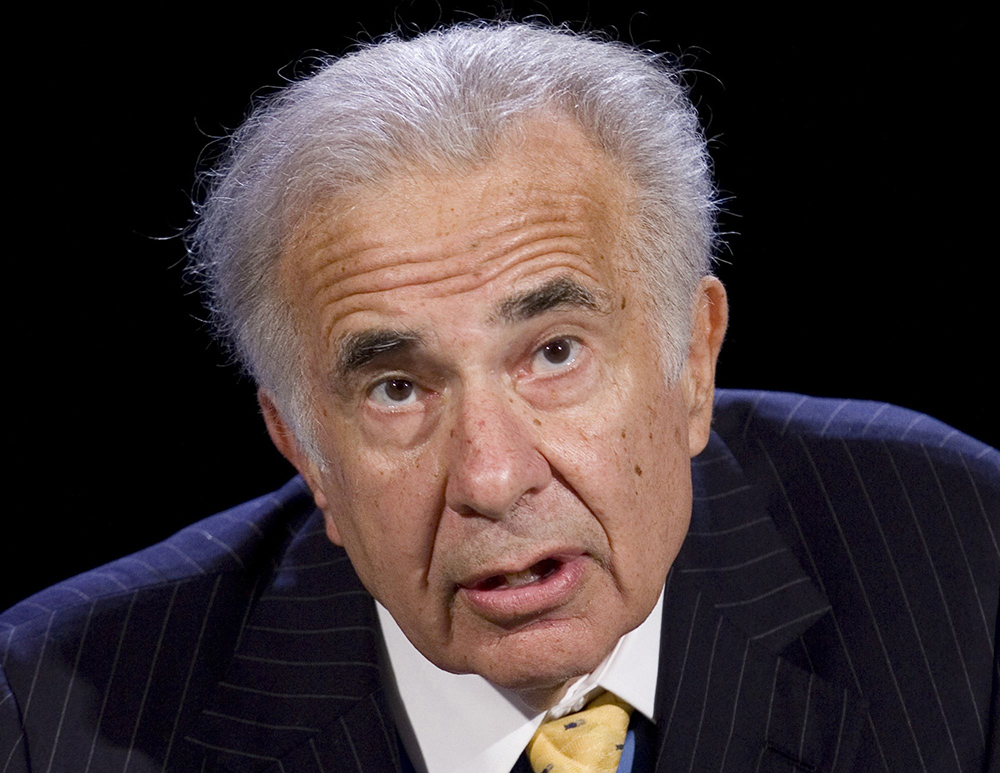

As per the WSJ, Mr. Icahn penned a letter which he planned to send out to Illumina’s shareholders on Monday. The letter says that holding on to Grail is costing Illumina about $800 million yearly, and that if Illumina is forced to divest Grail it will be on the hook to pay a hefty tax bill. In the letter, Icahn says that he plans to nominate three people to the San Diego company’s board, and that he had tried to settle it privately with the company and avoid the proxy battle. “We are convinced that at least three shareholder representatives are needed on Illumina’s board to attempt to put an end to this insanity now before the reckless decision making escalates into a no-return situation,” writes Mr. Icahn, the 87-year-old Queens-native who has an estimated net worth of 17.5 billion in 2023, as per Forbes.

Mr. Icahn maintains that his nominees for the board—Vincent Intrieri, founder and CEO of an investment fund as well as Jesse Lynn and Andrew Teno—all have expertise in dealing with crisis.

Illumina has said that it recommends its shareholders to vote against Mr. Icahn’s nominees. “Illumina has a diverse, experienced board comprised of directors who bring a range of perspectives to the company and represent the interests of its stockholders,” the company said in a statement. In reference to the merger, Illumina has said that divesting itself of Grail isn’t “proportional to the speculative harm alleged by the Commission, especially given the benefits this merger will bring to patients in the E.U. and across the globe.”