|

Getting your Trinity Audio player ready...

|

By: Serach Nissim

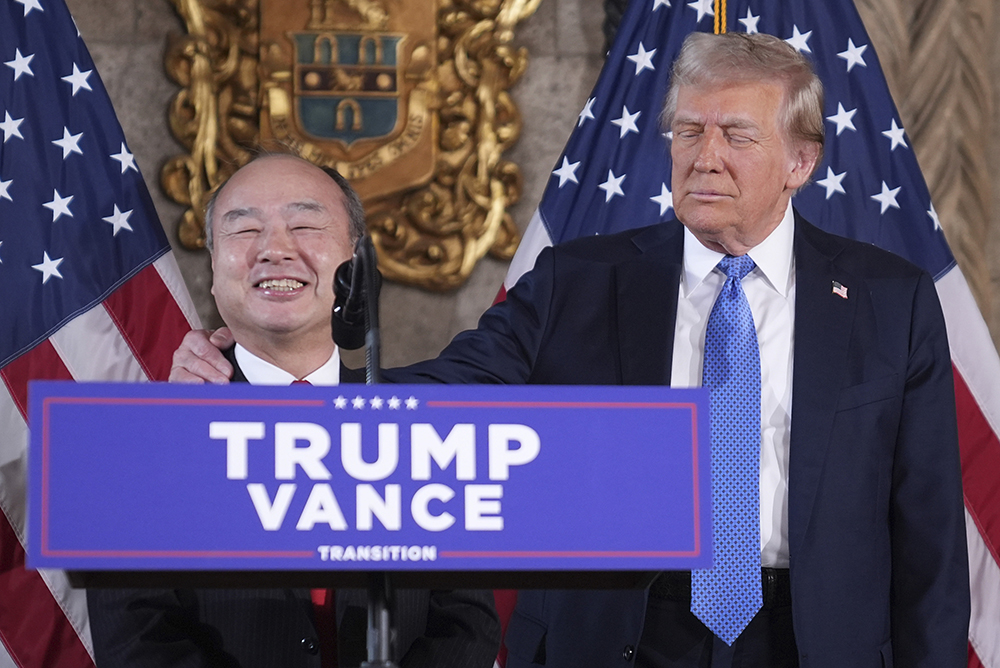

In December, before his inauguration, President Donald Trump and SoftBank CEO Masayoshi Son announced a $100 billion investment to create over 100,000 new jobs in artificial intelligence and related infrastructure in the U.S. As reported by the NY Post, last week, Hussain Sajwani, chairman of Damac, the Dubai-based luxury property developer, stood with Mr. Trump at Mar-a-Lago to announce another $20 billion investment in the Midwest and Sunbelt states for AI data centers and chip making. In the New York State area, chip makers are investing $112 billion, with the Albany NanoTech Complex becoming the home of CHIPS for America EUV Accelerator, one of only three National Semiconductor Technology Centers.

For many building owners and real estate players in NY, who are still experiencing the aftermath of the pandemic on their commercial properties, the AI boom seems to be the key to revitalizing the commercial real estate industry. “New York has the second-largest number of AI companies after California,” said Rahul Mewawalla of Mawson Infrastructure Group, which builds digital infrastructure for high-energy data centers that support AI, High Performance Computing (HPC), crypto mining, and blockchain growth.

Per the Post, over the past decade, AI firms have been swiftly expanding in NY, from representing less than 450,000 square feet to accounting for over 4.8 million square feet. Although many AI firms are headquartered in Silicon Valley, the talent they trying to lure, seems to increasingly be in the Big Apple. “New York attracts both graduates and the employee base,” said Jamie Katcher of JLL Real Estate. “Almost 40% of relocators to New York are coming from the West Coast and the venture money pouring into New York is driving part of this surge.”

CBRE reported that Manhattan boasts close to 190,000 high-tech jobs, with “more help” wanted ads posted daily. “AI needs access to a highly skilled workforce with a distinct set of skills apart from the broader tech industry,” noted Sacha Zarba of CBRE. “The fact that employees want to come to the office to work in New York is a huge driver for overall demand.” As proof of this, OpenAI, led by CEO Sam Altman, just leased 90,000 square feet at the Puck Building at 295 Lafayette St in SoHo. “OpenAI not only capitalized on the unique, 30,000-square-foot floorplate, which is rare in Soho, but on a building with characteristics that a young technology company craves,” Zarba said of space.

Harvey, the San Francisco-based firm which specializes in AI for law firms, recently leased 17,000 square feet at 315 Park Ave. South. Also, Captions, the generative video and editing AI firm, took on a lease of 15,000 square feet at 71 Fifth Ave. in the Flatiron area by Union Square, the Post reported. “It’s no surprise these companies are sitting in the core of Midtown South,” said Katcher. “They want to have flexibility to expand and contract depending on where they are in the growth cycle. They are cautious, growth-wise, and signing short-term leases and not oversubscribed in their initial location.”

Per the Post, what’s even more heartening is the AI startups that are moving from submarkets with smaller floor plates like Soho, Union Square and Park Ave. South, to neighborhoods like Chelsea and Hudson Square, where they have room to expand. As an example, Genius Sports, is moving its local headquarters from 825 Third Avenue in Midtown, to Chelsea and is doubling its footprint to 22,454 square feet at 512 W. 22nd St.