|

Getting your Trinity Audio player ready...

|

By: Chaya Abecassis

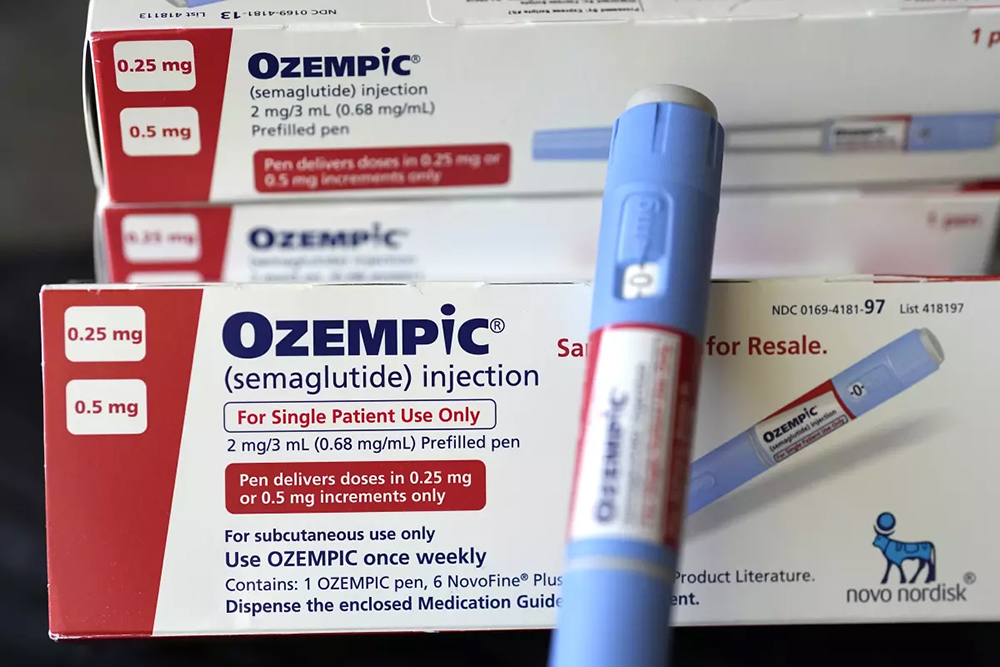

In a move that could reshape the consumer health landscape, Novo Nordisk, the Danish pharmaceutical powerhouse behind the blockbuster weight-loss drugs Ozempic and Wegovy, has announced that both medications will soon be available at Costco pharmacies across the United States. As The New York Times reported on October 5th, this unprecedented retail expansion reflects the company’s effort to retain dominance in the increasingly crowded — and fiercely competitive — weight-loss drug market.

Beginning later this month, Costco members with valid prescriptions will be able to purchase four-week supplies of either Ozempic or Wegovy for $499, a price that is dramatically lower than the current list price. The company said in a statement that its goal was to make “access to our medicines more convenient, meeting people where they are.”

The strategy, The New York Times report observed, marks an evolution in the way pharmaceutical companies are approaching consumer engagement — bypassing traditional pharmacy models to ppartner directly with trusted retail giants.

According to the information provided in The New York Times report, more than 500 Costco pharmacies nationwide will carry the injectable medications, which contain semaglutide, the active ingredient that suppresses appetite by mimicking the hormone GLP-1 (glucagon-like peptide-1). The expansion is expected to draw a wave of new customers to Costco’s pharmacy counters, many of whom have been turned away by insurance companies reluctant to cover these high-cost drugs.

For members paying out of pocket, the $499 price point represents a significant discount. As The New York Times report noted, that figure is roughly half the list price for Ozempic and nearly two-thirds less than Wegovy’s sticker price — which has reached as high as $1,349 per month in some markets. Executive members and Costco Citibank Visa cardholders will also receive an additional 2 percent cash-back incentive, further sweetening the deal.

While The New York Times report emphasized that the true out-of-pocket cost will vary depending on insurance coverage, the company’s decision to align itself with a high-volume, membership-based retailer underscores its broader mission: to normalize prescription weight-loss drugs as part of the American consumer’s routine healthcare experience.

Novo Nordisk’s decision to strike a deal with Costco comes at a critical juncture for the pharmaceutical giant. Despite generating $24 billion in global sales in the first half of 2025, the company has faced mounting challenges. As The New York Times reported, Novo Nordisk’s share price has plunged more than 50 percent this year, and in September the company announced plans to eliminate 9,000 jobs — about 11 percent of its global workforce — in an effort to cut costs and reposition for long-term growth.

Just months earlier, the company replaced its chief executive amid investor concerns that the firm had overextended itself in the battle for control of the GLP-1 market.

Still, as The New York Times report noted, Novo Nordisk remains determined to hold onto its lead against rivals like Eli Lilly, whose own weight-loss drug Zepbound — built on the compound tirzepatide — has emerged as a formidable competitor. Lilly announced in February that it would offer Zepbound vials for $499 per month, matching Novo Nordisk’s current pricing for Wegovy and setting off what analysts have dubbed a “retail price war” in the obesity treatment sector.

The rivalry has become a defining feature of the pharmaceutical industry’s most profitable new frontier. Together, semaglutide and tirzepatide are projected by Morgan Stanley to drive a $150 billion global market by 2030, making obesity drugs the most lucrative category in modern medical history.

Costco’s entrance into this market may prove transformative. As The New York Times report highlighted, the warehouse retailer attracts more than 100 million customers annually and is the third-largest global retailer, behind only Walmart and Amazon. Its pharmacies already fill millions of prescriptions each month, benefiting from the company’s reputation for reliability and competitive pricing.

The move reflects a broader shift in consumer behavior. Increasingly, Americans are bypassing traditional pharmacies for more convenient, one-stop-shopping experiences — a trend that The New York Times report noted has accelerated since the pandemic.

By offering semaglutide products through Costco, Novo Nordisk not only secures direct access to a massive potential customer base but also capitalizes on the retailer’s brand loyalty and purchasing power.

“This is more than a pricing maneuver,” one health economist told The New York Times. “It’s a statement of intent. Novo Nordisk wants to make Wegovy and Ozempic as commonplace as Costco’s rotisserie chicken — affordable, accessible, and part of everyday American life.”

At the heart of this commercial expansion lies a drug that has become a cultural phenomenon. As The New York Times has extensively reported, semaglutide works by imitating the naturally occurring GLP-1 hormone that slows digestion and triggers the brain’s satiety signals.

Originally developed as a diabetes medication, Ozempic quickly gained traction for its side effect: substantial, sustained weight loss. Wegovy, a higher-dose version of semaglutide specifically approved for obesity treatment, followed shortly thereafter.

A landmark study cited by The New York Times found that participants who took semaglutide for four years lost an average of 10 percent of their body weight, maintaining that loss over time — a feat unmatched by previous weight-loss drugs.

This effectiveness, coupled with the perception of safety, has catapulted semaglutide into the cultural mainstream, earning it nicknames like “the miracle shot” and fueling a 700 percent increase in GLP-1 prescriptions between 2019 and 2023 for patients without diabetes.

Yet experts caution that the hype must be tempered with realism. The New York Times has repeatedly noted that discontinuing semaglutide often leads to rapid weight regain, underscoring that the medication must be taken indefinitely to sustain results. Moreover, side effects such as nausea, vomiting, and gastrointestinal distress remain common, though typically manageable.

Despite its popularity, Wegovy remains largely uncovered by U. S. health insurers, many of whom still classify obesity as a “lifestyle issue” rather than a medical condition. As The New York Times reported earlier this year, most private insurance plans and even Medicare exclude coverage for weight-loss drugs, creating a major barrier to access.

Novo Nordisk’s partnership with Costco is, in part, a direct response to that problem. By offering semaglutide products at a flat, out-of-pocket price, the company sidesteps the complex and often hostile insurance reimbursement system.

For patients, that simplification could be a game-changer. “Consumers don’t want to spend weeks fighting with insurers,” a retail analyst told The New York Times. “If they can walk into Costco, flash a membership card, and leave with a month’s supply of Wegovy, that convenience alone could drive massive adoption.”

The expansion of semaglutide access into mainstream retail spaces carries profound economic and cultural implications. As The New York Times report noted, the meteoric rise of GLP-1 drugs has already begun reshaping multiple industries — from food and beverage companies adapting to smaller portion trends, to airlines adjusting their projections for passenger weights.