|

Getting your Trinity Audio player ready...

|

(TJV NEWS) Global oil markets are bracing for severe disruption as tensions escalate around the Strait of Hormuz, a vital chokepoint that handles roughly one-fifth of the world’s oil supply. JPMorgan’s projection of Brent crude prices soaring into triple digits—potentially reaching $120–$130 per barrel—now appears increasingly plausible amid rising threats to international shipping in the region, Zero Hedge reported.

Oil Price.com wrote: JP Morgan is sticking to its base-case oil price forecast for 2025, projecting Brent crude will trade in the low-to-mid $60s, despite a sharp escalation in geopolitical tensions involving Iran, the U.S., and potentially Israel.

In a note published Thursday, the bank said it sees oil averaging $60 in 2026, but flagged $120–$130 per barrel as a potential range in the event of worst-case outcomes—namely, military conflict and a closure of the Strait of Hormuz, through which one-fifth of global oil flows

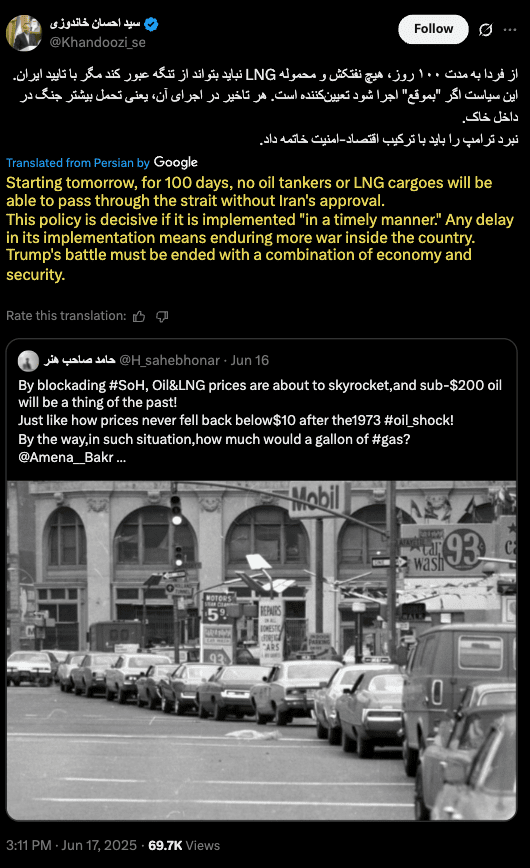

The most ominous signal yet came overnight in a post on X (formerly Twitter) from Ehsan Khandouzi, Iran’s former Economy Minister. While not an official government decree, his statement may reflect internal consensus—or act as a warning.

“Starting tomorrow, for 100 days, no oil tankers or LNG cargoes will be able to pass through the strait without Iran’s approval,” Khandouzi declared, adding that implementing the policy “in a timely manner” was essential to prevent deeper conflict within Iran.

The timing of the threat is notable, especially as the Islamic Revolutionary Guard Corps (IRGC) has reportedly increased naval activity in the area. Analysts warn that Iranian interference with commercial shipping could trigger the very supply shock that would validate JPMorgan’s oil forecast.

The Strait of Hormuz, at just 21 miles wide at its narrowest point, is one of the most strategic maritime corridors on the planet. It links the Persian Gulf with the Indian Ocean and is responsible for approximately 30% of global seaborne oil trade and 20% of liquefied natural gas (LNG) shipments.

In recent days, reports of widespread GPS jamming across the strait have added to the alarm. The disruption may have played a role in a collision early Tuesday between two oil tankers—Front Eagle and Adalynn—which ignited a massive fire aboard the latter and sparked fears of an environmental disaster, Zero Hedge Pointed out

JPMorgan’s analysis warns that a full blockade of the Strait would cripple the flow of oil from the Gulf region, sending global energy prices soaring and throwing financial markets into disarray.

Amid these developments, former U.S. President Donald Trump reportedly met with his national security team for more than an hour on Tuesday, followed by a phone call with Israeli Prime Minister Benjamin Netanyahu. The possibility of direct U.S. involvement in the conflict is rising—a scenario that would all but guarantee shipping disruptions in the strait and unleash ripple effects across global markets.

As geopolitical fault lines deepen, the world’s most critical energy artery may be on the verge of being throttled—placing global supply chains, fuel prices, and strategic stability in peril.