|

Getting your Trinity Audio player ready...

|

By: Russ Spencer

Stock futures edged lower on Sunday night in a measured but unmistakable response to President Donald Trump’s bold decision to order targeted strikes on three key Iranian nuclear sites. The operation — launched over the weekend and confirmed in a nationally televised address — marked a dramatic and historic escalation in the ongoing Israel-Iran conflict, thrusting the United States into a central role.

According to a report that appeared on Sunday at VIN News, the precision airstrikes hit strategic targets in Fordow, Isfahan, and Natanz — facilities that have long been regarded as the core of Tehran’s nuclear enrichment infrastructure. The move followed days of intense speculation about whether the United States would join Israel in a more aggressive posture against Iran. While Trump had previously signaled that a decision could take weeks, his rapid and unexpected action caught Tehran and global markets off balance.

In the immediate aftermath of the strikes, U.S. equity futures recorded modest losses. As reported by VIN News, Dow Jones Industrial Average, S&P 500, and Nasdaq futures all declined between 0.3% and 0.4% in after-hours trading. While not a panic-driven selloff, the downward movement reflected broader investor unease amid rising geopolitical tensions.

“This is a classic example of short-term volatility being triggered by geopolitical uncertainty,” said Jay Woods, chief global strategist at Freedom Capital Markets, in comments reported by VIN News. “Markets tend to overreact in the early days of conflict, but history shows that bold, clear decisions often stabilize investor confidence over time.”

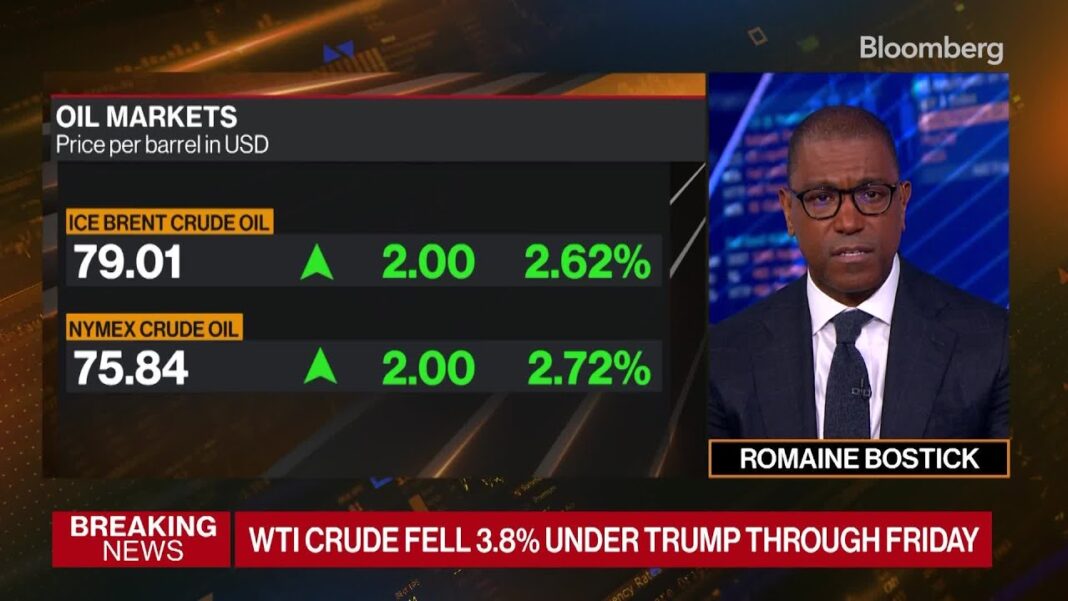

More pronounced was the impact on energy markets. Oil prices surged nearly 4%, rising to just under $77 per barrel on fears of regional instability and potential disruption to global supply chains — particularly if Iran were to retaliate in ways that affect maritime routes through the Strait of Hormuz.

Analysts at Goldman Sachs noted that Iran’s capacity to respond via proxy groups or by attacking oil infrastructure in the Gulf region is a risk factor that “will be closely monitored by energy traders in the coming days.” VIN News echoed similar assessments, pointing to the potential for broader conflict as a key source of market anxiety.

In his speech to the nation Saturday evening, President Trump framed the operation as both a defensive necessity and a moral imperative. “Iran’s key nuclear enrichment facilities have been completely and totally obliterated,” he declared. “Iran, the bully of the Middle East, must now make peace. If they do not, future attacks will be far greater and a lot easier.”

The statement was characteristic of Trump’s longstanding approach to foreign affairs — what his supporters have termed “peace through strength.” According to VIN News, the administration made it clear that the strikes were intended to reestablish deterrence after what officials described as a decade of failed appeasement and unchecked Iranian aggression.

White House National Security Adviser Keith Kellogg, speaking to VIN News, said the strike was “months in the making,” but that Trump’s instinct was to act only when diplomacy had clearly run its course. “We tried quiet channels. Iran rejected every overture. The President acted in the interest of American and global security.”

The strikes came after a week of intensified Israeli operations, including successful attacks on Iranian missile batteries and nuclear infrastructure, as well as the reported elimination of multiple Islamic Revolutionary Guard Corps (IRGC) generals and nuclear scientists. Trump’s action, seen as a force multiplier for Israel’s campaign, is being interpreted in diplomatic circles as a signal that the U.S.-Israel strategic alliance remains as robust as ever.

As the VIN News report observed, the strikes could signal a paradigm shift in how U.S. deterrence is projected across the globe. After years in which adversaries like Iran, Russia, and China have tested American resolve, Trump’s decision may reset the perception of U.S. willingness to act unilaterally — even in the face of criticism from international bodies.

“Trump’s move is not just about Iran,” said Retired Brigadier General Mark Berman, a frequent VIN News contributor. “It’s about restoring the idea that American red lines matter. And that changes how allies and adversaries calculate their next steps.”

Indeed, the precision and limited nature of the strikes suggest a calibrated effort to cripple Iran’s nuclear infrastructure without triggering full-scale war, a tightrope walk that underscores the complexity of modern conflict management.

Still, Iran’s next move will be pivotal. If Tehran retaliates directly against U.S. forces or assets, markets could react far more dramatically, and Washington may feel compelled to respond with greater force. That would test not only Trump’s military doctrine but also Wall Street’s risk tolerance.

For investors, the focus now shifts to several key fronts: how Iran will respond, what follow-up actions the Trump administration may take, and whether the broader Middle East sees an escalation that disrupts oil flows or trade.

VIN News reported that while corporate earnings and interest rates remain the dominant drivers of long-term equity performance, geopolitical shocks can alter sentiment rapidly, particularly in sectors like energy, defense, and logistics.

Defense stocks were already climbing in post-market trading, with Lockheed Martin and Northrop Grumman both seeing small upticks. Meanwhile, airline and hospitality shares dipped, reflecting fears of reduced travel to and from the Middle East.

Bond markets remained relatively stable, with only a slight dip in yields — a sign that investors may be bracing for turbulence but are not yet in panic mode.

President Trump’s weekend strike on Iran represents a high-stakes gamble — one with potentially far-reaching consequences. For now, Wall Street is reacting with measured caution, interpreting the strikes as bold but not yet destabilizing. As VIN News reported, the broader verdict will depend on Iran’s reaction and whether the U.S. can contain this show of force to a one-off operation.

What’s clear, however, is that the Trump doctrine of decisive unilateralism is back on full display, and with it comes both investor anxiety and a recalibration of geopolitical risk. Whether markets can weather the next chapter in this volatile saga may depend less on missiles and more on the strategy behind them.