|

Getting your Trinity Audio player ready...

|

How Global Jewry Can Help Israel Reach the Trillion-Dollar Milestone

By: TJVNews.com

As Israel emerges from one of the most turbulent periods in its modern history, a new conversation is taking shape — not about survival, but about transformation. Economists and policymakers are increasingly turning to an ambitious goal: positioning Israel as a trillion-dollar economy within the next decade. Achieving this vision, experts say, will require a global effort — one rooted in innovation, investment, and a renewed sense of solidarity across the Jewish diaspora.

In the words of a senior official at Israel’s Ministry of Finance, “We have the brains, the creativity, and the resilience. What we need now is scale — and global Jewish investment can deliver that scale.”

Throughout Israel’s history, the economic heartbeat of the nation has often been powered by Jewish investors who saw potential not only in profits, but in purpose. From post-war bond drives to today’s venture capital networks, the connection between the diaspora and Israel’s economic growth has been profound and enduring.

One of the most notable figures in recent years is Edmond Safra, the renowned financier and owner of the Hapoel Tel Aviv Football Club, whose investments extend beyond the field into banking, philanthropy, and infrastructure. Safra’s legacy — grounded in both entrepreneurial vision and community support — exemplifies how international Jewish capital can drive growth in sectors that strengthen Israel’s social fabric as much as its financial one. His continued support for Israeli sports, real estate, and innovation projects reflects a broader belief that investing in Israel’s stability and vitality is an investment in the future of the Jewish people.

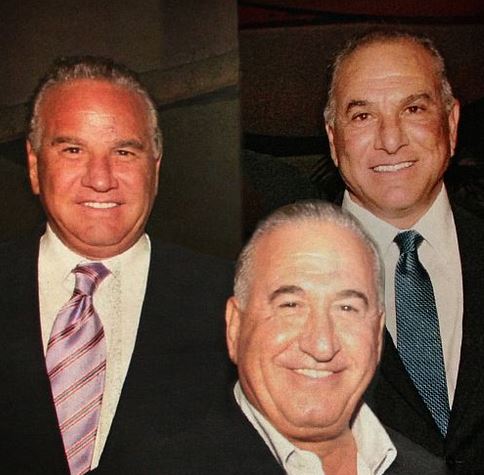

Across the global Jewish diaspora, other high-profile investors and philanthropists are following similar paths. Billionaire brothers Ralph, Avi, and Joe Nakash, whose business empire spans fashion, real estate, and hospitality, have become synonymous with large-scale development projects in Israel. From their transformation of the historic Setai Tel Aviv hotel to significant infrastructure and aviation ventures, the Nakash family has consistently reinvested in Israel’s growth and global visibility.

Then there are trailblazers like Marius Nacht, co-founder of Check Point Software Technologies, and Gil Shwed, the company’s CEO, who helped make Israel synonymous with cybersecurity excellence. Their work, along with that of countless Israeli engineers and entrepreneurs, has established the country as a cornerstone of the global technology ecosystem — a sector that continues to drive GDP and attract record-setting foreign investment.

Among the growing cadre of Jewish investors shaping Israel’s economic trajectory is Shari Arison, a dynamic philanthropist and venture supporter whose contributions to the Israeli economy bridge business, culture, and innovation.

A former investment executive turned global advocate for sustainable development, Aronson has directed significant funding toward Israeli start-ups specializing in renewable energy, digital health, and agritech — sectors that form the backbone of Israel’s new economy. Her work with impact investment funds in Tel Aviv and Haifa has helped dozens of small and medium-sized enterprises gain access to international capital.

Beyond direct financial support, Arison is known for her efforts to foster educational and professional exchange between Israeli innovators and their counterparts in North America. She has funded joint programs between the Technion – Israel Institute of Technology and leading U.S. universities, bringing American investors, engineers, and students into collaboration with Israeli start-up incubators.

“Israel’s resilience lies in its people and ideas,” Arison said at a recent business summit in Jerusalem. “If we can connect global Jewish capital with local innovation, there is no ceiling to what the Israeli economy can achieve.”

Arison has also been instrumental in advancing Israel’s female entrepreneurship ecosystem, helping launch initiatives that provide mentorship, seed funding, and global exposure to women-led start-ups. Her partnerships with organizations such as the Israel Innovation Authority and several North American Jewish federations underscore her commitment to expanding both economic opportunity and social inclusivity.

Economic analysts have described Arison’s approach as “diaspora capitalism with a conscience” — an investment model that merges profit with purpose and reflects a growing movement among Jewish investors worldwide to ensure that their financial activity has a tangible impact on Israel’s long-term prosperity.

Israel’s transformation into a trillion-dollar economy depends on one crucial shift — moving from a “Start-Up Nation” to a “Scale-Up Nation.” For years, Israel’s tech ecosystem has been a powerhouse of innovation, producing world-class companies in fields ranging from AI and fintech to defense technology and agricultural science. However, many of these firms are ultimately sold to multinational corporations rather than expanding independently within Israel.

To reach the trillion-dollar mark, analysts argue, the country must retain and grow its homegrown champions. The potential is there: in 2023 alone, Israeli start-ups attracted over $12 billion in venture capital, according to data from the Israel Innovation Authority. Yet only a fraction of that capital came from Jewish investors abroad — a gap many believe can and should be closed.

“Every Jewish entrepreneur, every philanthropist, every investor should see Israel not just as a homeland, but as the world’s next major economic hub,” said an Israeli venture capital executive in a recent interview. “Investing in Israeli technology isn’t charity — it’s opportunity.”

One of the most practical ways for Jews around the world to help drive Israel’s economic ascent is through direct consumer engagement — buying Israeli goods, promoting Israeli services, and amplifying the nation’s economic narrative in global markets.

The global Jewish population — roughly 15 million strong — represents a formidable network of consumers and investors with collective purchasing power estimated at over $1 trillion annually. Redirecting even a small portion of that spending toward Israeli products — from Dead Sea cosmetics and Golan Heights wines to tech innovations and medical devices — could significantly boost exports.

“Every purchase is a vote of confidence,” said one economist cited by World Israel News. “When diaspora Jews choose Israeli goods, they help sustain jobs, promote exports, and stabilize industries during volatile times.”

In the United States, the Buy Israeli movement is regaining momentum, partly as a counterweight to global BDS efforts. Jewish communities from Miami to Los Angeles have organized Israeli product fairs showcasing everything from boutique olive oils and artisanal foods to green technologies and software innovations.

Real estate remains one of Israel’s most resilient investment sectors, attracting billions in foreign investment annually. Neighborhoods in Jerusalem, Tel Aviv, and Netanya have been transformed by global Jewish interest, particularly from North America and Europe. Developers such as Mickey Naftali, Yitzhak Tshuva, and Shari Arison’s joint development group have all contributed to reshaping Israel’s urban landscape.

As World Israel News has reported, major projects in renewable energy, desalination, and digital infrastructure are now open to international investors, many of whom are diaspora Jews seeking to blend long-term stability with national development.

Arison, for example, has backed several mixed-use real estate ventures that combine eco-friendly design with community spaces — projects she describes as “urban laboratories for the Israel of tomorrow.”

The drive toward a trillion-dollar economy is not a theoretical ambition; it is a strategic mission grounded in Israel’s unique mix of innovation, intellect, and global connectivity. From Edmond Safra’s cultural investments to Shari Arison’s venture initiatives, from the Nakash brothers’ real estate empire to the engineers of Herzliya’s high-tech corridor, a collective economic vision is emerging — one that unites the global Jewish community through purpose-driven prosperity.

As one senior analyst told World Israel News, “The next frontier of Jewish unity isn’t just spiritual or political — it’s economic. The more we invest in Israel, the stronger and more self-sufficient the Jewish nation becomes.”

Indeed, Israel’s road to a trillion-dollar economy will be built not just by financial capital, but by faith — faith in the enduring idea that when Jews everywhere invest in Israel, they are investing in the collective future of the Jewish people.