|

Getting your Trinity Audio player ready...

|

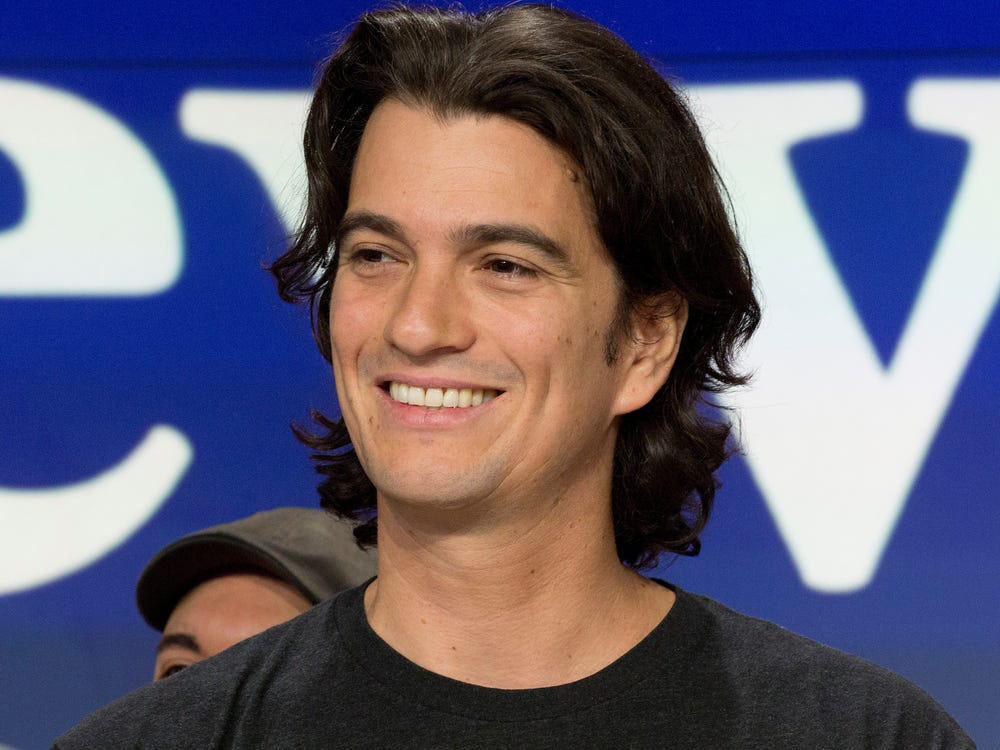

Adam Neumann Eyes WeWork Resurgence Amid Bankruptcy

Edited by: TJVNews.com

Adam Neumann, the ousted co-founder and former chief executive of WeWork, is making waves once again as he endeavors to reclaim control of the beleaguered co-working company, which filed for bankruptcy less than five years after his departure, as was reported on Tuesday in the Wall Street Journal.

In a bold move, Neumann, along with partners including Dan Loeb’s Third Point hedge-fund firm, is exploring the possibility of bidding for WeWork, according to a letter sent by his lawyers to WeWork’s advisers, according to the WSJ report. This initiative comes amidst signals from some WeWork creditors indicating readiness to sell the firm post-bankruptcy.

However, Neumann’s efforts are encountering resistance from WeWork executives who have reportedly withheld crucial information necessary for him to submit a bid. Despite Neumann’s expressed interest since December, the company’s management has remained reticent, as highlighted in the letter reviewed by The Wall Street Journal.

Moreover, uncertainty looms over Third Point’s commitment to collaborating with Neumann on the potential acquisition. According to the information provided in the WSJ report, a spokeswoman for Third Point clarified that the hedge fund has not yet committed to any transaction and has engaged in only preliminary discussions with Flow Global, Neumann’s real-estate company.

WeWork’s financial woes have exacerbated the situation, with the company facing a cash crunch and the urgent need for additional funds to navigate its complex chapter 11 proceedings. The WSJ report said that Neumann, in his letter to WeWork, attributed the current predicament to management’s alleged failure to explore alternative avenues for financial support.

For Neumann, this audacious bid represents a pivotal juncture in his tumultuous relationship with WeWork and its largest investor, SoftBank. The information in the WSJ report said that despite SoftBank’s substantial investment in WeWork and Neumann’s subsequent departure with a lucrative exit package exceeding $1 billion, the company’s fortunes spiraled downward, culminating in a disappointing IPO valuation in 2021.

SoftBank, the Japanese conglomerate, infamously injected billions into WeWork in 2017, propelling its meteoric rise and subsequently shouldering staggering losses exceeding $14 billion, as revealed in corporate filings, according to the WSJ report. Now, Neumann, enriched by SoftBank’s investment, seeks to reclaim control of the company he co-founded.

WeWork, mired in bankruptcy proceedings since its November chapter 11 filing, faces a crucial juncture as it navigates its future under the stewardship of a SoftBank-appointed CEO, the report in the WSJ said. While management initially signaled intentions to hand over control to creditors and steer the company toward profitability, diverging perspectives among creditors have emerged.

Some creditors advocate for a swift sale of WeWork post-restructuring, contrary to management’s plans for continued operation under creditor control, as per the WSJ report. Neumann’s bid to rally support from WeWork’s major creditors faced setbacks, with reports indicating that his overtures were met with skepticism.

Despite Neumann’s efforts, discussions have unfolded among bankers at PJT Partners, WeWork’s investment bank, regarding the feasibility of a post-bankruptcy sale of the company, as was indicated in the WSJ report. These deliberations underscore the complexity of WeWork’s restructuring process and the divergent interests at play among stakeholders.

Neumann’s ambition to orchestrate WeWork’s resurgence amidst bankruptcy represents a pivotal moment in the company’s tumultuous history. As stakeholders navigate the intricate landscape of restructuring negotiations, the fate of WeWork hangs in the balance, with Neumann’s bid injecting a new layer of intrigue into the saga of the co-working behemoth.