|

Getting your Trinity Audio player ready...

|

By: Jerome Brookshire

A legal dispute unfolding in New York’s Supreme Court is offering art market observers an unusually detailed look inside the high-stakes world of third-party guarantees at auction. As reported by Artnet.com last week, Phillips auction house has initiated court action against prominent collector and film producer David Mimran over his failure to pay for a Jackson Pollock painting he backed under a third-party guarantee arrangement.

The dispute centers on a significant transaction at Phillips’s modern and contemporary evening sale held on November 19, 2024. According to documents reviewed by Artnet.com, Mimran entered into a third-party guarantee — commonly known in the trade as a “TPG” — for a Pollock artwork carrying an unpublished estimate of $13 million. This mechanism, widely utilized in recent years as the art market soared, allows an outside party to assume the risk of a lot failing to sell, thereby providing financial assurance to the auction house.

As the report at Artnet.com explained, the benefit for the guarantor lies in securing the work at a pre-arranged price if bidding fails to meet expectations. Alternatively, if competition at auction pushes the price beyond the guarantee, the backer typically shares in a percentage of the proceeds above the minimum. In this case, however, the arrangement did not unfold as either party had anticipated.

During the November auction, bidding on the Pollock stalled below the minimum threshold, meaning Mimran was contractually obliged to acquire the painting for the guaranteed price of $14.5 million. When more than 120 days elapsed without payment, Phillips turned to the courts for enforcement, filing a motion for summary judgment seeking the original purchase price plus interest, legal fees, and other charges totaling $14,957,448.38.

The case has drawn attention partly because of the transparency it has brought to an often opaque area of art market practice. Court filings include the third-party guarantee agreement, the invoice, and a signed “affidavit for confession of judgment” dated April 26, 2025, in which Mimran acknowledged his debt to Phillips.

In response to inquiries from Artnet.com, Mimran described the dispute as a matter of timing rather than refusal to pay. “I love the painting and will buy it — just a little late, which happens often in this market and most auction houses have had to deal with this,” Mimran stated via email. He claimed that Phillips approached him approximately two weeks before the auction to guarantee the Pollock. Despite some hesitation, he agreed, citing his affection for Pollock’s work and previous ownership of a piece by the artist. Mimran asserted that he had requested his standard six-month payment terms due to anticipated cash flow constraints.

Mimran’s attorney, contacted by Artnet.com, declined to comment on the matter.

Representing Phillips, attorney Luke Nikas offered a sharply contrasting perspective. Speaking with Artnet.com, Nikas criticized Mimran’s actions, remarking, “It’s astonishing that Mimran believes he can bid like a billionaire and then hide behind the claim that he’s broke. If Mimran didn’t have a dollar to his name to pay for the artwork, as he claims, then he shouldn’t have raised a paddle.”

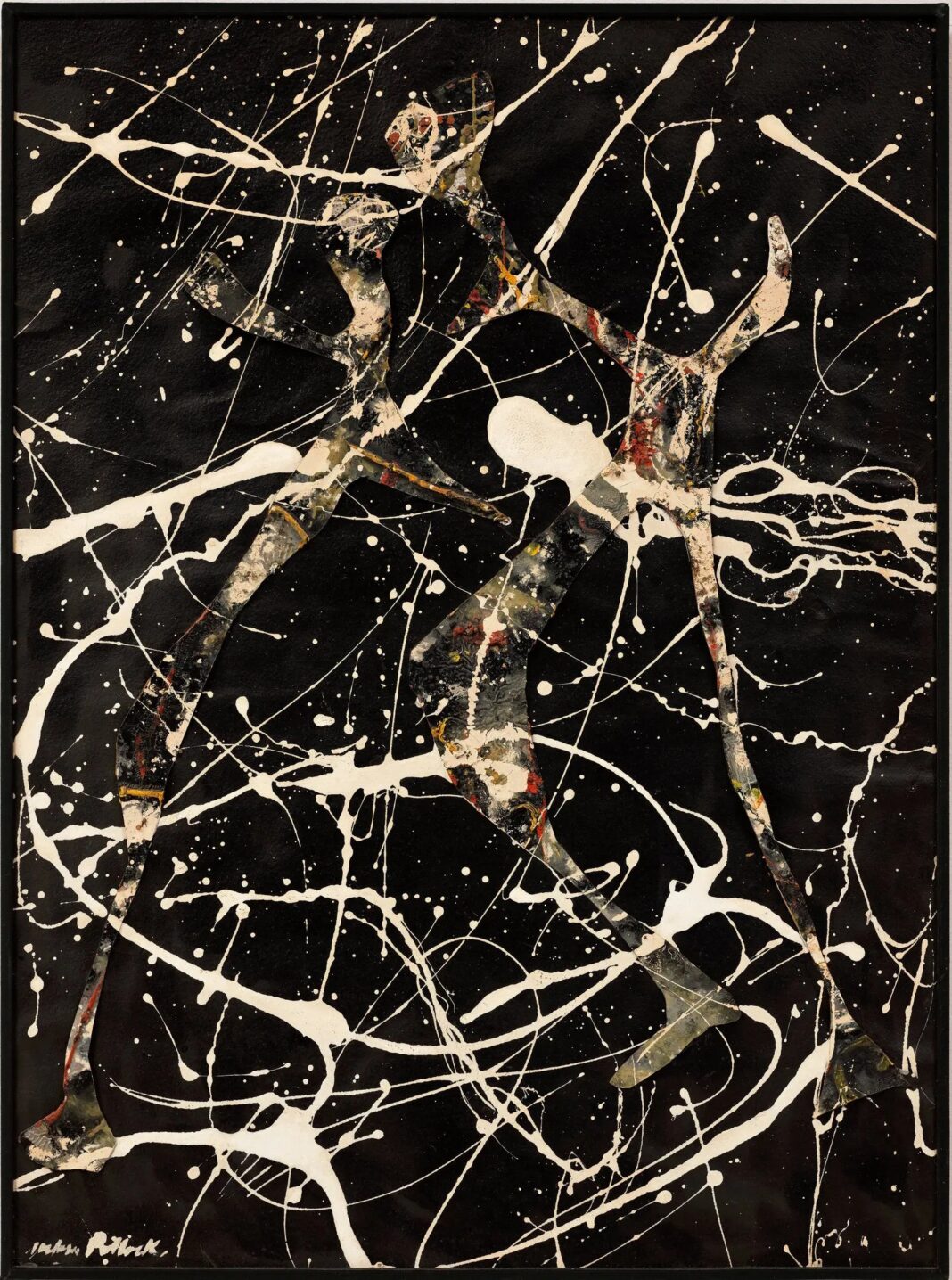

The painting in question, a mixed-media work created by Pollock in 1948, features oil, enamel, pebbles, and cut-outs on paper mounted on Masonite. According to Phillips’s catalogue entry, the work is signed by Pollock on the lower left. As quoted by Artnet.com, Pollock once reflected on his experimental approach, stating, “I like to use fluid paint. I also use sand, glass, pebbles, string, nails or other matter… I want to express my feelings rather than illustrate them.”

Phillips, through its catalogue, described the piece as “a stunning example of Jackson Pollock’s coveted white-on-black ‘drip’ paintings,” a series highly prized among collectors and museums. The artwork’s provenance includes notable former owners such as designer Florence Knoll and her banker husband Harry Hood Bassett. The painting was featured in several significant exhibitions, including the 1998 Pollock retrospective at New York’s Museum of Modern Art.

Mimran, a known figure in both art and film circles, is also recognized as the son of Jean-Claude Mimran, a billionaire dubbed “The Sugar King of Africa.” Jean-Claude Mimran oversees a business empire controlling West Africa’s leading sugar refinery, along with the region’s largest flour milling, alcohol distilling, and raw materials shipping operations. With a net worth estimated at $2 billion, Jean-Claude’s business prominence has often cast a spotlight on his family’s other ventures.

Despite his financial background, David Mimran’s involvement in this legal battle has prompted fresh scrutiny of the third-party guarantee practice. Artnet.com has analyzed how such guarantees, while offering risk mitigation for auction houses, also expose guarantors to significant liabilities if market dynamics shift unexpectedly.

As the court proceedings unfold, the case continues to generate discussion among art market professionals about the risks associated with high-profile guarantees. While defaults on auction purchases are not unheard of, the public nature of this dispute — with its detailed documentation in court filings — presents a rare glimpse into the mechanics and potential pitfalls of third-party guarantees.

In the high-stakes world of art auctions, where multimillion-dollar transactions are sometimes brokered on short notice, this dispute highlights the complex interplay between financial risk, collector ambition, and contractual obligation. Artnet.com has emphasized that beyond the financial implications, the outcome of this case may influence future practices regarding guarantees and payment terms in the global auction industry.

For now, Phillips remains steadfast in its legal pursuit of payment, and Mimran’s next steps — whether compliance, settlement, or continued litigation — are being closely followed by a market keenly attuned to the repercussions of this high-profile standoff. The case stands as a telling example of the delicate balance between art market glamour and financial accountability.