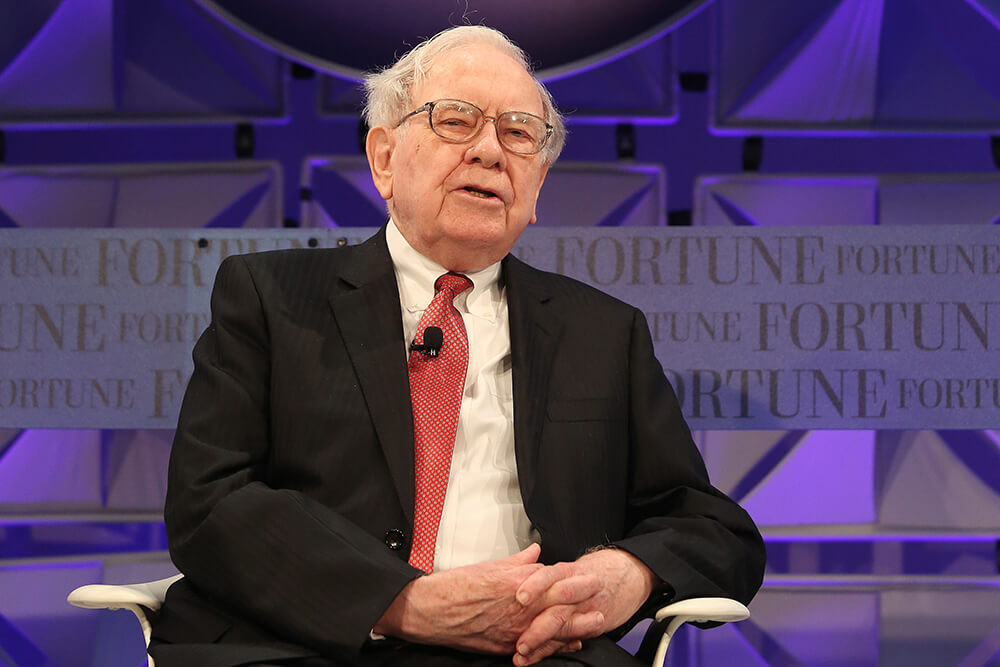

Billionaire investor Warren Buffett told CNBC last week that a money manager at his company, Berkshire Hathaway, has been purchasing shares in Amazon of late. The result was predictable: shares of Amazon rose by over 3%.

“Yeah, I’ve been a fan, and I’ve been an idiot for not buying” Amazon shares, Buffett said during his interview on CNBC. “But I want you to know it’s no personality changes taking place.”

Berkshire Hathaway Inc., based in Omaha, Nebraska, owns a range of businesses including insurance, railroads, jewelry stores as well as major investments in American Express, IBM and Wells Fargo & Co.

“The idea that value is somehow connected to book value or low price to earnings ratios — as Charlie has said, all investing is value investing,” Buffett told the assembled at Berkshire Hathaway’s latest annual meeting. He added, “I mean you are putting some money out now to get some money later on, and you are making a calculation as to the probabilities of getting that money and when you will get it.”

“The ‘Oracle of Omaha’ disclosed this week that one of his investment managers — either Ted Weshcler or Todd Combs — has bought some of Amazon’s stock in recent months. The purchase likely caught many Buffett watchers by surprise, even when considering Buffett’s praise through the years for Amazon founder Jeff Bezos,” reported Yahoo Finance.

“But there is a catch to the Oracle of Omaha’s admission that Berkshire has been a buyer of Amazon — namely, that Buffett hasn’t been the brainchild behind the buying. Rather, it was either Todd Combs or Ted Weschler, each of which manage portfolios that total more than $13 billion in equities for Berkshire, who did the buying during the first quarter,” reports The Motley Fool.

Buffett “was clear with Quick about Amazon in saying, “Yeah, I’ve been a fan, and I’ve been an idiot for not buying.” In essence, Buffett admits that not personally buying Amazon a long time ago was a mistake, but is quick to note that this purchase was not of his doing or influence, even though he appreciates Amazon’s competitive edge and what Jeff Bezos brings to the table as a leader,” the Motley Fool added.

The company knows what it is doing. Amazon is already capable of offering same-day and next-day delivery to 72% of the total U.S. population, including almost all of the households (95% or more) in 16 of the wealthiest and most populated states and Washington, D.C., according to a report published in March by RBC Capital Markets.

“The vast delivery network is the result of significant investments over the past four years, a period during which Amazon built out fulfillment centers across the country, nearly tripling its U.S. logistics infrastructure, RBC said. Amazon has added roughly double the amount of distribution space Home Depot currently owns.