|

Getting your Trinity Audio player ready...

|

By: Ellen Cans

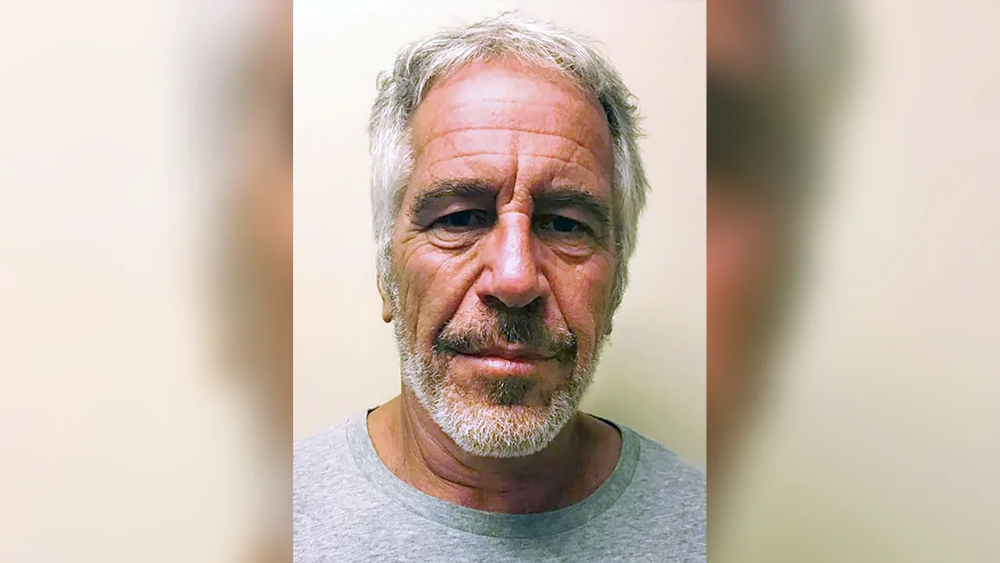

Congressional investigators want Bank of America to be investigated for flagging suspicious payments to convicted sex trafficker Jeffrey Epstein only after he died. As per a recent article in the NY Times, in 2020 Bank of America filed two “suspicious activity reports,” or SARs, eight months apart, to alert financial regulators about potentially suspicious payments from billionaire investor Leon Black, to disgraced Jeffrey Epstein. Filing a SAR, is a mandatory routine practice, which is meant to alert law enforcement of potential criminal activities like money laundering, terrorism financing or sex trafficking.

They are expected to are expected to be filed within 60 days after a bank notices a questionable transaction. In this case, however, the SARs were not filed until several years after the payments, which totaled $170 million, and were made between 2012 and 2017.

A congressional memo alleges that the first SAR filed by Bank of America was six months after Epstein had already taken his own life in a Manhattan jail, following his arrest on federal sex trafficking charges. The congressional investigators say that Bank of America should be investigated for the delayed filings. The bank may have violated federal laws against money laundering. The investigators also wonder why the bank processed the payments “without asking for information as to the nature of the transactions,”

the memo said. The bank had told regulators in its initial filing that the wire transfers had “no apparent economic, business or lawful purpose,” according to the memo.

The congressional investigation highlights that delayed SAR filings have become common practice by many banks. The congressional memo was prepared by staff working for Senator Ron Wyden, the Oregon Democrat who serves as chair of the Senate Finance Committee. Per the Times, the memo recommends that Mr. Wyden ask the Treasury Department’s Financial Crimes Enforcement Network to investigate Bank of America’s conduct. A spokesman for Mr. Wyden said he was still considering the recommendations, but was likely to follow them. Senator Wyden already sent a letter to Bank of America’s chief executive, Brian Moynihan, asking about the due diligence the bank had conducted.

“A late filing, in and of itself, isn’t an indication you were lax or bad,” said Elise Bean, a former chief counsel to the Senate Permanent Subcommittee on Investigations, whose specialty has been money-laundering investigations. Ms. Bean said the question for regulators is whether a bank was “deliberately late” in filing the report. Ms. Bean said sometimes after news surfaces, it prompts a bank to go back and review its records and retroactively flag a transaction as suspicious, whereas they had not previously seen a problem with it.

For the past two year, the finance committee has been conducting its own investigation into the large payments Mr. Black made to Epstein. These investigations, started in 2020, led Mr. Black to step down in early 2021 as chief executive of Apollo Management, the private equity firm of which he was a co-founder. Per the NY Times, Mr. Black, a Bank of America customer with a net worth of $13 billion, has insisted that the payments were shelled out for legitimate tax work done by Epstein and advice on art transactions. Dechert, a law firm hired by Apollo to review Mr. Black’s dealings with Mr. Epstein found that the work had saved Mr. Black roughly $2 billion in federal taxes. The law firm also said there was no evidence Mr. Black knew of Mr. Epstein’s predatory behavior.