|

Getting your Trinity Audio player ready...

|

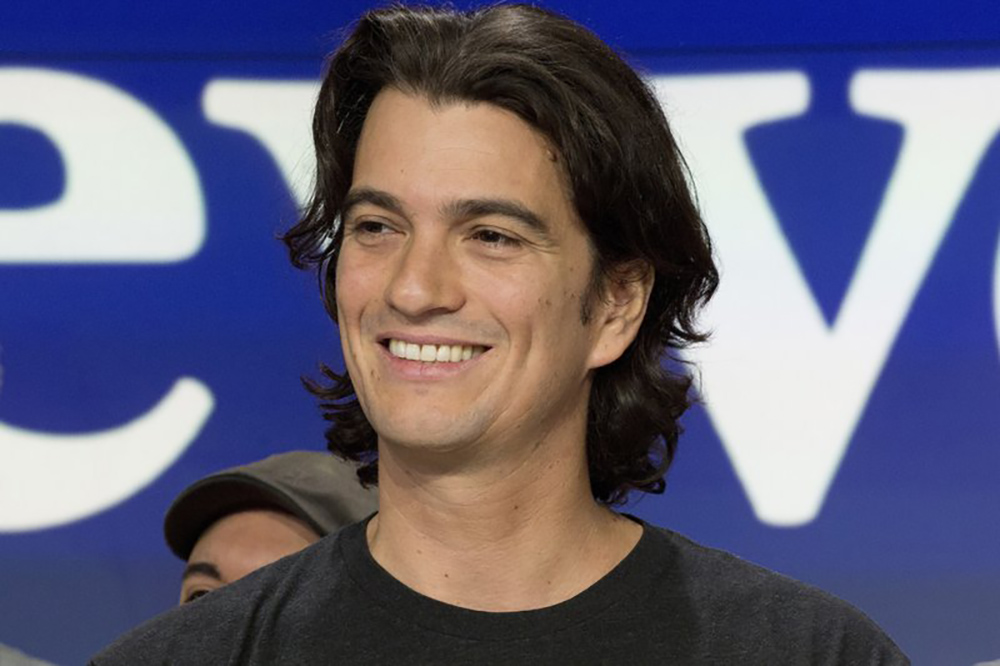

Adam Neumann’s Miami Real Estate Ventures: A Growing Presence in the Magic City

Edited by: TJVNews.com

Amidst the ongoing saga surrounding WeWork and its former CEO Adam Neumann, his real estate startup Flow Global has set its sights on Miami, with plans to undertake significant developments worth $300 million, as was reported in the New York Post. The project aims to transform what was once a tent city for the homeless into a vibrant urban center, comprising rental apartments, retail spaces, and small offices.

According to a preliminary document filed on MuniOS, an online repository for municipal offerings, the Miami developments are part of the larger Miami Worldcenter project, an ambitious urban mixed-use redevelopment endeavor spanning over 20 acres and involving multiple city blocks and developers.

A spokesperson for Flow Global confirmed the venture to the Post, highlighting the significance of the Miami Worldcenter project in revitalizing the area and creating a dynamic urban landscape. The development is poised to include both office and retail spaces, with completion expected by 2025, pending site plan approval.

However, questions have arisen regarding the ownership structure of the projects associated with the Miami Worldcenter. While initial reports suggested that 166 2nd Financial Services, the family office of Adam Neumann and his wife, was leading the development efforts, a spokesperson for Flow Global disputed this claim, according to the information provided in the Post report. In a statement to Bloomberg, the spokesperson emphasized that any references linking Neumann or his family office to the project were inaccurate.

In response to the discrepancy, a spokesman for the Miami Worldcenter indicated that the document would be updated to reflect Flow Global’s ownership stake, the report in the Post said. Nonetheless, the exact extent of Flow’s involvement and ownership remains unclear at this juncture.

The proposed developments in Miami represent a significant investment by Flow Global and underscore the company’s commitment to urban revitalization and real estate innovation. Despite the uncertainties surrounding ownership and project details, the venture signals a bold step forward in Neumann’s post-WeWork endeavors and solidifies Miami’s status as a burgeoning hub for real estate development and investment.

The anticipated pricing of Miami Worldcenter on March 26th has sparked speculation about the extent of Neumann’s influence in the burgeoning development.

According to a document reviewed by Bloomberg, firms associated with Neumann have been involved in the Miami Worldcenter project since at least 2021. The Post report indicated that Flow Global, Neumann’s real estate startup, secured financing to contribute to the construction of the second phase of the Caoba, a 44-story luxury residential tower. As of December, the Caoba boasted an impressive 95% occupancy rate, highlighting the demand for upscale living spaces in Miami’s thriving market.

In collaboration with Florida-based developers Falcone Group and Merrimac Ventures, Flow Global is poised to expand its footprint in Miami with the construction of a new 41-story apartment tower adjacent to the Caoba, the Post reported. Set to welcome residents later this year, the upcoming tower promises to offer an array of amenities, including retail and office space, catering to the diverse needs of Miami’s urban population.

The combined value of these developments is estimated to reach approximately $300 million, according to a projection by Concord Group, a leading real estate consulting firm and reported on by the Post. This substantial investment underscores Neumann’s commitment to revitalizing Miami’s urban landscape and capitalizing on the city’s burgeoning real estate market.

Despite Neumann’s controversial departure from WeWork in 2019, his entrepreneurial spirit and vision for innovative real estate ventures remain undeterred. Since founding Flow Global, Neumann has continued to attract significant investment, leveraging his expertise and experience to spearhead ambitious projects in Miami and beyond.

However, Neumann’s involvement in the Miami Worldcenter project raises questions about his role and influence in shaping the city’s skyline. The Post report mentioned that critics point to Neumann’s tumultuous tenure at WeWork, marked by reports of eccentric behavior and corporate mismanagement, as cause for concern. Nonetheless, supporters argue that Neumann’s entrepreneurial acumen and track record of success position him as a valuable contributor to Miami’s ongoing urban renaissance.

Neumann, 44, has embarked on a bold endeavor, utilizing his new startup, Flow, as a vehicle to raise capital and make a bid for the embattled co-working giant.

Neumann’s ambitious plans have garnered significant attention, particularly his efforts to secure funding from prominent investors like venture capital firm Andreessen Horowitz and hedge fund titan Dan Loeb, as per the information contained in the Post report. With $350 million already raised from Andreessen Horowitz, Neumann is poised to leverage additional capital from Loeb to acquire WeWork or its assets and provide crucial bankruptcy financing.

In a letter addressed to WeWork’s advisers, Neumann’s legal counsel, including esteemed attorney Alex Spiro, accused the company’s advisers of a lack of cooperation in facilitating the acquisition process. The Post report indicated that Spiro highlighted the importance of transparency and collaboration in ensuring a “value-maximizing transaction for all stakeholders” and expressed frustration over the lack of access to essential information necessary for making an informed offer.

Neumann’s involvement in WeWork’s fate predates the current bid, with years of attempts to invest in the company thwarted by management decisions. Despite Neumann’s efforts to arrange a meeting with WeWork’s then-CEO to discuss a substantial equity infusion, the process was abruptly halted without explanation, according to Spiro’s letter.

Whether Neumann succeeds in his quest to resurrect WeWork or faces further setbacks remains to be seen, but one thing is certain: the battle for control of WeWork is far from over.