|

Getting your Trinity Audio player ready...

|

Edited by: TJVNews.com

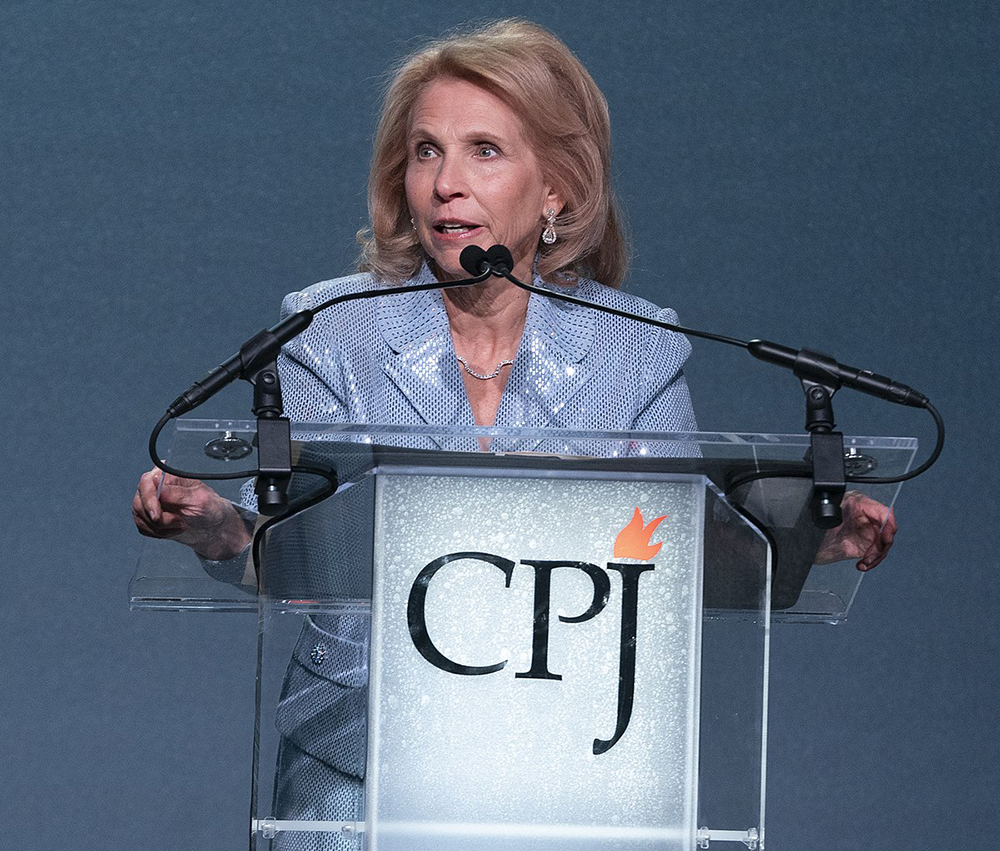

Media mogul Shari Redstone faces a pivotal decision regarding the future of Paramount Global, the media conglomerate under her control through the family holding company National Amusements, as was reported by The Wall Street Journal. Recent discussions with key industry figures about a potential sale and the looming possibility of significant cost cuts reveal the complex challenges Paramount is navigating in a rapidly evolving media landscape.

Redstone has recently engaged in talks with Skydance Media Chief Executive David Ellison and Activision CEO Bobby Kotick regarding the potential sale of Paramount Global, according to the WSJ report. The discussions come at a crucial time for the media giant, prompting Redstone to weigh the decision of whether to sell the company or seek alternative strategies to reshape its fortunes.

Paramount Global is preparing for further cost-cutting measures, contemplating the potential layoff of over 1,000 workers early next year. As was indicated in the WSJ report, a weaker-than-expected ad-sales market has necessitated aggressive cost reductions to meet investor expectations of positive earnings growth by 2024. The company has been streamlining its workforce throughout the year in response to financial pressures.

Complicating Paramount’s financial outlook are the expiring carriage deals with two major cable companies in the coming months. The report in the WSJ also said that these negotiations add another layer of uncertainty, contributing to the broader challenges faced by the media conglomerate.

The media landscape has posed significant challenges for Paramount. Structural declines in its once-lucrative cable channels, coupled with the aftermath of prolonged strikes in Hollywood affecting productions, have impacted the company’s revenue streams, the WSJ report said. Additionally, the flagship Paramount+ streaming service continues to incur losses.

Redstone’s contemplation of selling National Amusements, despite her past battles for control within the company, underscores the tough decisions media executives are confronting. According to the WSJ report, Paramount Pictures, the crown jewel of the conglomerate, is a key asset that Redstone is determined not to sell independently, despite potential buyer interest primarily in the movie studio.

Sources indicate that Redstone wishes to allocate more time to non-media pursuits. In the wake of the Oct. 7 attacks by Hamas on Israel, she has become more involved in organizations opposing anti-Semitism, the WSJ report noted. Additionally, Redstone has recently constructed a home in the Caribbean, signaling her desire to spend more time with her family.

Redstone had hoped for a rebound in Paramount’s stock before entertaining offers. Paramount’s shares experienced a nearly 12% decline this year, reaching $15 a share before reports of discussions with potential buyers, the WSJ reported. The stock closed at $16.24 per share on Monday.

Paramount faces imminent challenges as its distribution deals with Comcast and Charter are set to expire. The deal with Comcast concludes at the end of the month, while the Charter agreement is slated to end this spring, according to the WSJ report. Securing renewals for these deals is vital for Paramount to maintain the presence of its TV networks in households across the United States. Failure to do so could have significant consequences for the company’s reach and revenue streams.

Recent industry events, such as Disney’s networks going dark for over a week during a dispute with Charter earlier this year, underscore the complexities of carriage deals. As was indicated in the WSJ report, Charter ultimately agreed to pay Disney more for its TV channels, showcasing the negotiation dynamics in an evolving media landscape. Paramount seeks to navigate similar negotiations to ensure the continued distribution of its networks.

A diverse array of potential buyers has expressed interest in National Amusements’ assets. Among them are billionaires, studios, streamers, and private-equity companies. Notably, discussions between Activision CEO Bobby Kotick and Shari Redstone have taken place in recent weeks regarding a potential purchase of National Amusements, the WSJ report said. However, these talks have not progressed, signaling the intricacies involved in such negotiations.

Netflix executives have explored the possibility of a deal with National Amusements, particularly expressing interest in Paramount’s movie studio, Paramount Pictures, the report in the WSJ said. However, discussions have reportedly cooled as Netflix concentrates on efforts to limit password sharing. Paramount Pictures, home to iconic franchises like “Mission Impossible” and “Top Gun,” remains an attractive asset for potential buyers.

SkyDance Media Chief Executive David Ellison, in collaboration with investor RedBird Capital, has also shown interest in Paramount’s movie studio. Their discussions reportedly extend to the prospect of acquiring all of National Amusements. As was reported by the WSJ, the history of successful collaborations between SkyDance and Paramount on projects like “Top Gun: Maverick” adds another layer of complexity to potential negotiations.

Warner Bros. Discovery, led by Chief Executive David Zaslav, is contemplating the pros and cons of pursuing Paramount. Paramount’s studio, coupled with ownership of CBS, known for broadcasting National Football League games and long-standing hits like “NCIS,” presents an enticing proposition for Warner Bros. Discovery, the WSJ report noted.

Zaslav, known for strategic decision-making, has not actively pursued a deal with Paramount Global despite periodic dinners with Shari Redstone. The WSJ reported that Zaslav’s indication on a November earnings call that the company could be “opportunistic” in the next 12 to 24 months leaves the door open for potential deals, emphasizing a measured approach to future prospects.

The prospect of integrating Warner Bros. Discovery and Paramount Global is marked by the potential for billions in savings. However, the aversion to adding more cable networks to an already extensive portfolio, coupled with the likelihood of increased debt after the Discovery merger, has tempered enthusiasm for a deal, according to the WSJ report. Both companies are carefully weighing the financial implications and the impact on their respective structures.

Redstone, steering National Amusements, has taken deliberate steps to manage the company’s finances effectively. The $125 million preferred-equity investment from merchant bank BDT & MSD in May injected additional liquidity after Paramount cut its dividends for the first time in years, the WSJ reported. Redstone is proactive in maintaining financial stability, recognizing dividends as a key income source for the Redstone family.

National Amusements demonstrated fiscal responsibility by paying down 20% of the approximately $250 million outstanding loan to creditors in September. Another 15% repayment is scheduled for March. The report in the WSJ also said that Redstone and Paramount CEO Bob Bakish have prioritized retaining core assets, selling noncore assets like Simon & Schuster and rejecting offers, including a $3 billion bid for Showtime last year.

Paramount Global’s strategic focus extends beyond potential mergers and acquisitions. The company abandoned plans to sell a majority stake in BET Media Group, emphasizing a commitment to retaining assets integral to Paramount’s identity, the WSJ said. Paramount has resisted investor requests to spin off local broadcast stations, maintaining a holistic approach to its operations.

Paramount’s emphasis on partnerships is evident in its approach to streaming services. Paramount+ has forged alliances with Walmart’s membership program, Verizon (via a bundle with Netflix), and Delta SkyMiles members on flights, according to the WSJ report.