Article and Photos by Lieba Nesis

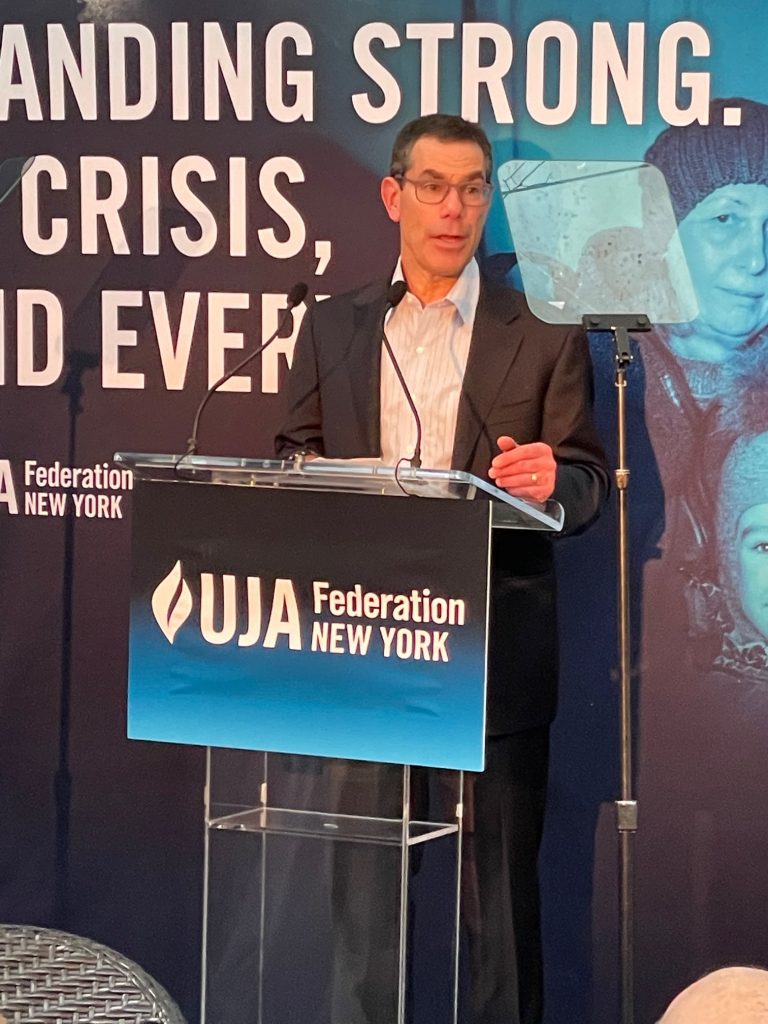

Tonight, nearly 100 suits from the world of private equity paid $500 to indulge in sushi and light bites while being kept up to date on UJA’s activities during the pandemic. UJA CEO Eric Goldstein told me it had been a crazy couple of years as the world has careened from crisis to crisis. Having just returned from Saudi Arabia, Goldstein noted its startling shift from mortal enemy to regional ally as Israel and Saudi Arabia continue its close alliance. UJA’s fundraising campaign continues at breakneck speed, with this small event alone amassing $1.1 million nearly the equivalent of major galas in New York City. For the record-breaking fundraising year ending June 30th over $180 million was raised with its December Wall Street dinner garnering a whopping $32 million. More than $80 million was allocated for emergency funding for Covid as well as $16 million of aid for Ukraine along with UJA’s consistent distribution of funds for the poor, elderly, those with special needs and disabilities, and extending a lifeline to isolated Holocaust survivors. UJA has also confronted Antisemitism head-on: including helping to enhance security at Jewish schools and community centers as well as doubling federal funding for nonprofit security from $90 million in 2020 to $180 million in 2021.

Tonight attendees proudly wore their name tags as Josh Nash, the son of Jack, spoke of his father’s escaping Nazi Germany and feeling the need to give back as one of the inventors of the leveraged buyout. Jack Nash, whose original name was Jack Nachtgeist, died in 2008, after having donated millions to Jewish cultural and social charities. Another UJA devotee and private equity honcho, Joel Beckman, co-founder of Greenbriar Equity Group, introduced Michael Klein, who he has known for over 30 years. Beckman praised Klein, his wife Bettina, and their three kids for seeking to better the world, as he recounted Michael’s family housing a student with them in Scarsdale for two years and how that student was the first in his family to graduate College because of Michael’s mentorship. Michael Klein humbly accepted his award while acknowledging that he initially was averse to receiving the attention but relented after having witnessed UJA’s Covid recovery work on a mission to Cuba. As an organization that assists teens afflicted by mental health issues Michael was honored to be a part of the evening acknowledging that the award was a motivator for him to step up and do more-as his colleagues nodded approvingly under the cloudy New York sky.

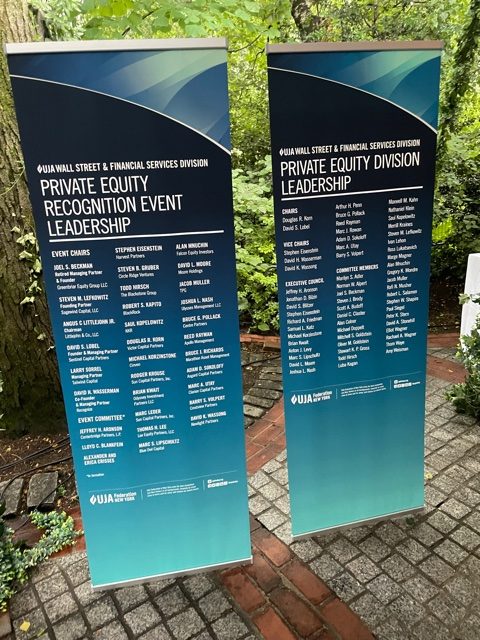

As New York seeks to return to its prior glory, the event season continues thriving with UJA holding one of its two big annual events at Tavern on the Green on Monday June 27th with cocktails beginning at 6 PM. Each year the organization chooses a private equity bigwig to receive the coveted Jack Nash Award and this year Michael I. Klein was recognized for his philanthropic and professional leadership. As CEO of Littlejohn & Co., a company he co-founded in 1996 which is based in Greenwich Connecticut, Michael has spearheaded the firm’s successful investment in middle market companies. With over $12 billion of assets under management the company continues to thrive under Klein’s stewardship with a recent sale in August 2021 of HydroChemPSC for $1.25 billion. The firm’s focus on operational turnarounds in industrial and service sectors provides it with a niche that has delivered generous returns.

Tonight, nearly 100 suits from the world of private equity paid $500 to indulge in sushi and light bites while being kept up to date on UJA’s activities during the pandemic. UJA CEO Eric Goldstein told me it had been a crazy couple of years as the world has careened from crisis to crisis. Having just returned from Saudi Arabia, Goldstein noted its startling shift from mortal enemy to regional ally as Israel and Saudi Arabia continue its close alliance. UJA’s fundraising campaign continues at breakneck speed, with this small event alone amassing $1.1 million nearly the equivalent of major galas in New York City. For the record-breaking fundraising year ending June 30th over $180 million was raised with its December Wall Street dinner garnering a whopping $32 million. More than $80 million was allocated for emergency funding for Covid as well as $16 million of aid for Ukraine along with UJA’s consistent distribution of funds for the poor, elderly, those with special needs and disabilities, and extending a lifeline to isolated Holocaust survivors. UJA has also confronted Antisemitism head-on: including helping to enhance security at Jewish schools and community centers as well as doubling federal funding for nonprofit security from $90 million in 2020 to $180 million in 2021.

Tonight attendees proudly wore their name tags as Josh Nash, the son of Jack, spoke of his father’s escaping Nazi Germany and feeling the need to give back as one of the inventors of the leveraged buyout. Jack Nash, whose original name was Jack Nachtgeist, died in 2008, after having donated millions to Jewish cultural and social charities. Another UJA devotee and private equity honcho, Joel Beckman, co-founder of Greenbriar Equity Group, introduced Michael Klein, who he has known for over 30 years. Beckman praised Klein, his wife Bettina, and their three kids for seeking to better the world, as he recounted Michael’s family housing a student with them in Scarsdale for two years and how that student was the first in his family to graduate College because of Michael’s mentorship. Michael Klein humbly accepted his award while acknowledging that he initially was averse to receiving the attention but relented after having witnessed UJA’s Covid recovery work on a mission to Cuba. As an organization that assists teens afflicted by mental health issues Michael was honored to be a part of the evening acknowledging that the award was a motivator for him to step up and do more-as his colleagues nodded approvingly under the cloudy New York sky.