Edited by: TJVNews.com

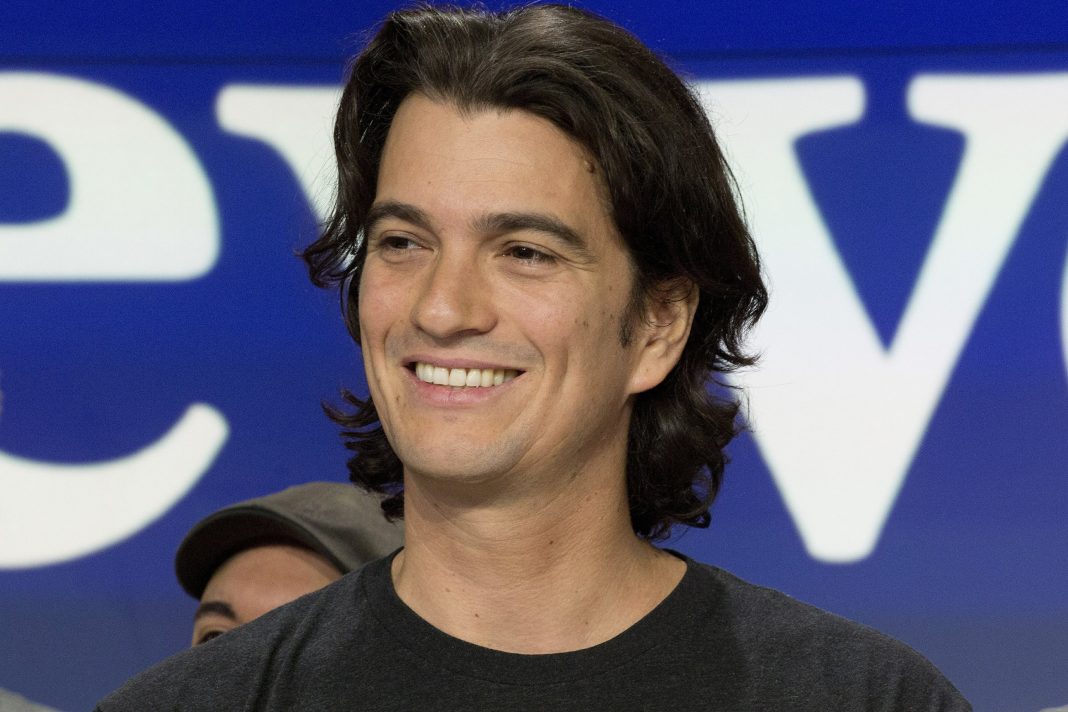

Seems like WeWork’s Adam Neumann will be taking a significant salary cut. According to reports that are circulating the WeWork co-founder is discussing a settlement with SoftBank that would cut his payout from the Japanese investment giant roughly in half.

The Israeli-American billionaire and the office sharing giant WeWork were so miffed at Softbank when it jettisoned plans to buy $3 billion worth of shares from its investors last spring that they both filed separate lawsuits against the bank.

Before you state getting misty eyed over Neumann’s salary cut, the NY Post reported that a deal is close to being sealed that would put Softbank in a position where it would be on the hook for $1.5 billion of the amount listed above. And that would include about $500 million that will go directly into Neumann’s pocket, according to a report that appeared on Monday in the Wall Street Journal.

A person who is familiar with the deal told CNBC that Softbank (who is the majority owner of WeWork) would receive 10.5 percent of stock in WeWork from the company’s investors who jumped on board early in the game in return for a rate of $19.19 per share, which just happens to be the price that was initially agreed to.

In 2019, WeWork was not successful in an attempt at an initial public offering and as such Neumann vacated his position as the CEO. It was agreed upon that Neumann would bail out with a lucrative exit package. If the deal does make any headway, the settlement for Neumann would involve a cut of $500 million off the $1,7 billion that he was expecting.

As per usual, both sides were mum when asked for comments on the on the negotiations taking place behind the scenes.

The NY Post reported that Marcelo Claure, the executive chairman of WeWork, who also happens to hold a top spot at Softbank had said in October that Neumann would be required to forego his hefty fee for consulting services as he was in violation of “some of the parts of the consulting agreement.” That essentially meant that Neumann would not collect a cool $185 million.

What specifically prompted settlement talks at this particular juncture could possibly be attributed to reports circulating that say that WeWork may might to try its hand again in going public through a merger with a special purpose acquisition company, according to a report in the NY Post.

For those not in the know, a special purpose acquisition company is a publicly traded shell company that hitches itself to another firm which then takes over its stock listing, as was reported by the NY Post.

The WSJ reported that WeWork has been in talks about joining forces with a SPAC called BowX Acquisition Corp. This deal could value it at roughly $10 billion. The Post reported that this figure is well below the $47 billion valuation the company was believed to be worth before Neumann failed at its first IPO attempt.

On the more salacious side of this story, the Post reported that prior to extricating himself from his CEO chair at WeWork, reports indicated that Neumann enjoyed partying and allegedly created a culture at the company that promoted such practices. The Post reported that Neumann also allegedly smoked marijuana while on a private jet. In terms of living a profligate lifestyle, the Post also reported that the WeWork CEO did not make substantial efforts to rein in spending at a company that was bleeding cash.