By: George Jenkins

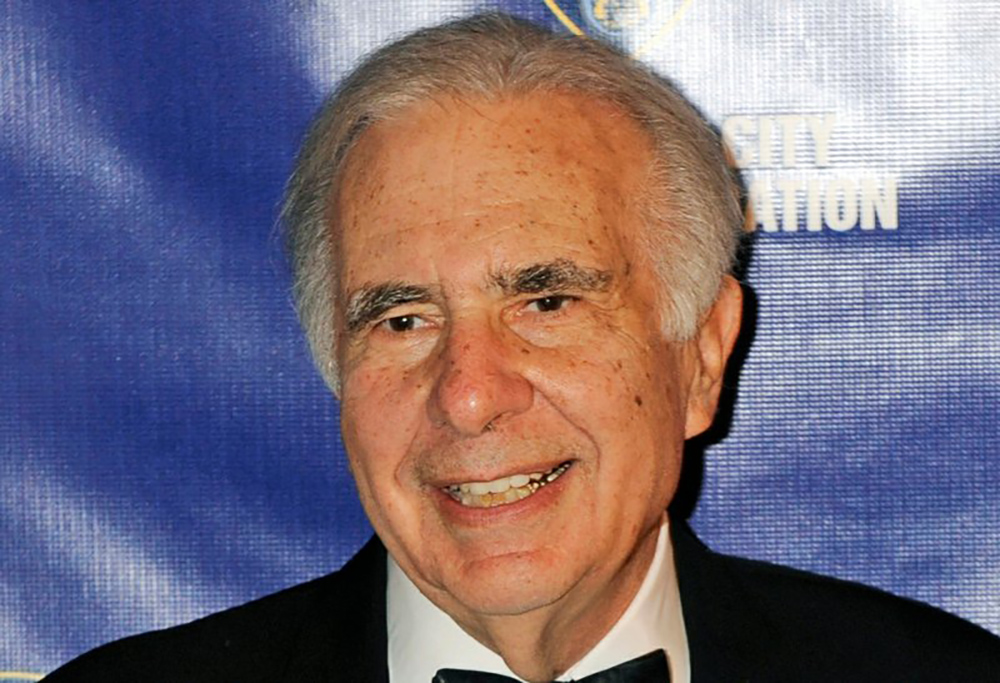

Corporate raider Carl Icahn now seems to be in the midst of a trucking battle. According to a New York Post report, the consummate deal-maker along with other major investors in trucking giant Navistar are on board with selling it to a Volkswagen subsidiary for around $50 a share. If the deal goes through, then Navistar would be worth $5 billion. Navistar is an international company that produces semi-trucks.

It appears, however, that the 84-year-old Icahn may be locking horns with Mark Rachefsky, a former protégé, who is also a significant shareholder in Navistar. The Post reported that according to those who have knowledge of the talks, Rachefsky may demand even a higher bid. Insiders have told the Post that whatever the outcome of the negotiations may be, Icahn is prepared to forge ahead with plans to get the deal done at what he believes is a reasonable price.

Sources close to the situation have told the Post that Traton, the truck manufacturing subsidiary of Volkswagen raised its offer to Navistar last month to $43 a share. This price represents an increase from $35 a share which was offered in January; prior to the emergence of the Coronavirus. The Post reported that it was told by sources familiar with the deal that Traton is “conducting diligence on Navistar and is expected to finish by the end of this week.”

It has also been reported that Traton may increase its offer of $43 per share by the middle of October, but by how much it will increase has not been finalized. The Post reported that Traton sees Navistar as “Volkswagen’s ticket into the US’s lucrative long-haul trucking business.”

As of this past Friday, Wall Street reported that shares of Navistar closed at $44. The word on the street is that this is an indicator that investors are anticipating that Traton will sweeten the deal in due course.

The bid that Navistar made last month was considered sufficient to restart merger talks, but the company which is the biggest manufacturer of trucks and truck parts has said that the most recent offer made by Traton “significantly undervalues” the business.

Traton is the biggest shareholder in Navistar with a 17 percent stake in the company. Carl Icahn and Mark Rachefsky each have a 16 percent ownership in the company. Icahn controls three board seats and the Post reported that two directors of Traton are locked out of merger talks. It was also reported that another three seats on the board are controlled by MHR Fund Management, a financial corporation owned by Rachefsky .

Sources close to Icahn and the way he thinks believe that he does not have complete control of the corporate boardroom but would be willing to accept approximately $50 a share.