The heads of the seven biggest banks in America talked to legislators last week about a variety of topics. It didn’t go especially well.

“With lawmakers on the House Financial Services Committee each getting five minutes to question the seven CEOs, the bank executives were consistently cut off when trying to give answers to the barrage of quick and often unconnected questions,” Crain’s New York Business reported. “The topics have spanned the political and banking spectrum, as ranking member Patrick McHenry called the gathering “a hearing in search of a headline.”

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, called for megabanks to craft a solution to help Americans saddled with student loan debt to achieve economic goals such as homeownership.

“I’m going to ask you in all that you do to think about all that student debt,” Chairwoman Waters said. “I know that you sold the debt and you’re not involved with student loans any more but we have a whole population of millennials who are out there, who are still the victims of the debt that was incurred because they were trying to get an education. I’m asking you if you can come up with a creative product of some kind to deal with this population of millennials who can’t buy a home, who can’t get married, who can’t buy an automobile, who don’t have insurance.…I don’t know what it is, I don’t know how you’re going to do it, but I’d like you to think about it and next year when you come, I hope that you can give us some answers.”

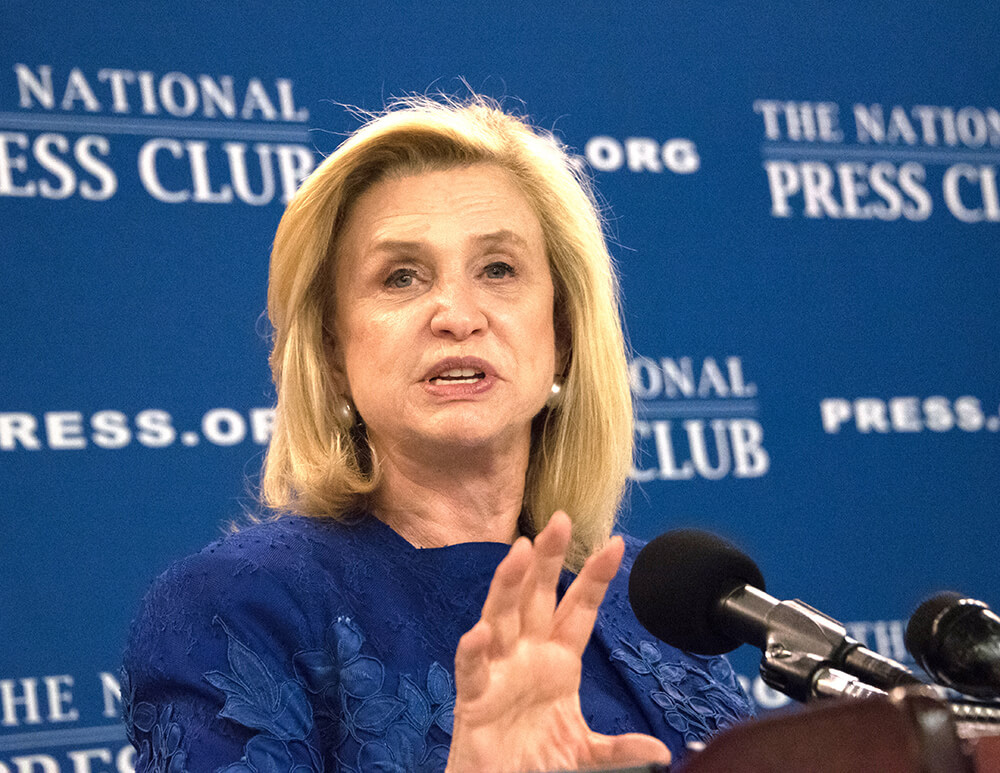

Another: Rep. Carolyn Maloney (D-NY), Chairwoman of the Subcommittee of Investor Protection and Capital Markets, grilled JPMorgan Chase & Co. CEO Jamie Dimon by asking: “After the Parkland shooting last year, where a lone gunman killed 17 student and staff with a military-style semiautomatic rifle, two of the banks on this panel, Citibank and Bank of America, stepped up to the plate and adopted formal policies limiting their business with certain gun industry clients, and I want to publicly thank them. Now, Mr. Dimon, last week you published your letter to shareholders. The section on responsible banking, you wrote the paragraph that is up on the screen right now. You said that turning down clients with low character is “often the only way to be a responsible bank.” Well, actions speak louder than words on guns, Mr. Dimon, and from what I can tell these are just words to you. Let’s talk about some of the actions on your bank’s activities.

Even after the horrific massacres at Sandy Hook, Las Vegas and Parkland, JPMorgan has arranged about 273 million dollars of loans for the manufacturers of military-style firearms, the same weapons that are being used in mass shootings all over our country. Even worse, last year JPMorgan took partial ownership of Remington, the manufacturer of the exact gun that was used to kill 20 children in the Sandy Hook shooting, And JPMorgan has refused to adopt a policy to ensure responsible lending to the gun industry, even though you claim client selection is important and even though two of your competitors have already adopted these policies. So my question is, will you live up to your own rhetoric, will you commit to adopting a formal policy that ensures responsible lending in your bank’s business with the gun industry?”